Along Connecticut’s I-95 spine, invoices move as fast as trucks on the Merritt Parkway—until one unpaid balance quietly slows the whole operation. From Stamford’s corporate finance corridor to New Haven’s biotech and research economy, B2B credit decisions happen daily—and disputes follow right behind them.

When a receivable stalls, you need an outcome that’s as steady as Long Island Sound: controlled, deliberate, and built to finish strong.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

The Commercial Reconciliation Workflow (Built for CT B2B Reality)

CA-USA doesn’t “chase debt.” Our Account Reconciliation Team resolves commercial balances in a way that preserves brand reputation and keeps the door open for future business.

1) Intake + Contract Intelligence

We collect the paperwork that actually wins cases: invoices, PO trail, delivery confirmation, emails, credit applications, and dispute notes. Then we verify the business entity and decision-makers—because getting the right person matters more than getting “a person.”

2) Verification + Multi-Channel Demand

We launch immediate notice through professional channels: email, mail, and direct outreach. This isn’t noise. It’s a clean, documented signal to Accounts Payable that your receivable is now being actively managed.

3) Human-to-Human Negotiation (No robo-pressure)

We reach out directly to CFOs, controllers, owners, and AP managers. The goal: resolve the reason behind the delay—vendor dispute, cash-flow timing, incomplete paperwork, short-pay deductions, or “we’ll pay next cycle” limbo—then convert that into a schedule that sticks.

4) Deep Investigation (When the story doesn’t match the balance)

If the account resists, we escalate with verification tools: USPS address checks, skip tracing, and bankruptcy screening. We also run a Litigation Scrub to identify high-risk profiles before you waste time or damage relationships.

5) Credit Reporting + Pre-Legal Review (Strategic leverage, not drama)

Where permitted, we can report to business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Commercial—a powerful non-legal lever that gets attention fast. If needed, we shift to pre-legal review and prepare the file for attorney action.

We initiate formal action through our expansive network of specialized litigators across the USA to secure a judgment, and take steps to enforce the judgment.

| Need a Commercial Collection Agency? Contact Us Serving Hundreds of Businesses !Easy to use • Fully Compliant with Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Over 20 years Experience • Free Commercial Credit Bureau reporting • Low fee • Highly Rated ! |

Performance-Based Value (Pure Contingency, Aligned Incentives)

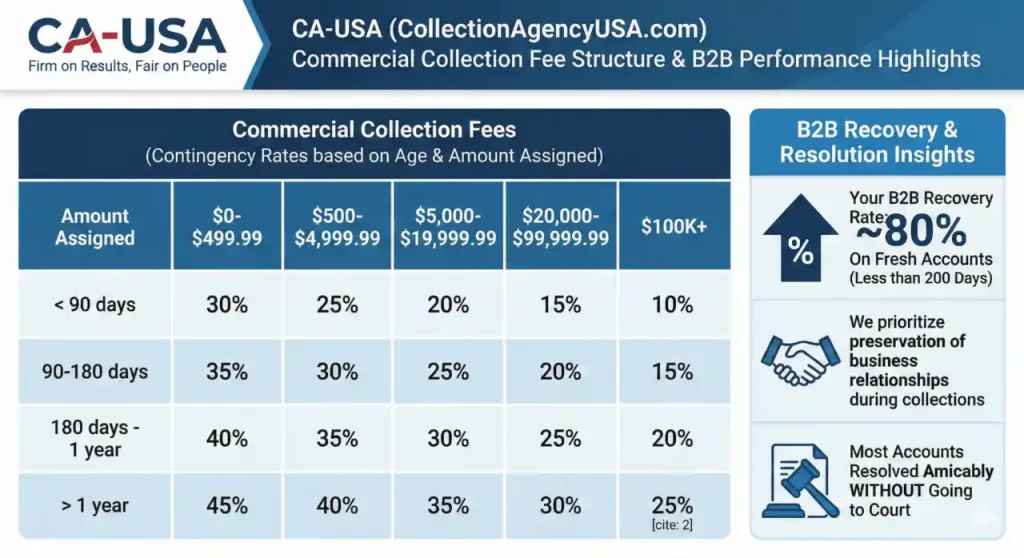

Our commercial collections model in Connecticut is 100% contingency-based. You pay only when we recover.

Fees typically range 10%–45%, based on balance size, account age, documentation strength, and complexity. Higher balances and younger debts generally receive the lowest rates, and we confirm pricing with you in advance so there are no surprises.

For fresh commercial accounts—under 200 days—we routinely achieve an ~80% recovery rate, because the debtor still remembers the transaction, the paper trail is intact, and reputation pressure still works.

Operational Edge: Speed Without Reputation Risk

Connecticut businesses run tight. Whether you’re supplying equipment off I-91, shipping through the Port of New Haven, or managing subcontractors near Bradley International Airport, time isn’t a luxury.

That’s why we move fast with email and text outreach where appropriate, and we recommend early assignment the moment internal reminders stop working. Our Bilingual (Spanish) team helps prevent misunderstandings and removes friction with diverse workforces—especially across the Bridgeport–Norwalk corridor.

Quality is non-negotiable: calls are recorded and reviewed to prevent rogue behavior and reduce “review-bomb” risk that can spill into your public reputation.

What Connecticut Businesses Ask Us to Resolve (Without Burning Bridges)

We work commercial accounts across the state’s real economy:

Medical suppliers and B2B healthcare vendors supporting New Haven and Fairfield County facilities; dental labs and distributors; construction and trades tied to project timelines; manufacturers and aerospace-linked vendors near Stratford; logistics and wholesale routes moving through I-95 and Route 15; education vendors serving UConn-linked departments and private institutions; staffing, IT, and professional services where approvals stall inside AP.

The theme is consistent: your customer may be slow—but you still want the relationship. We structure resolutions that collect cleanly while letting both sides keep working.

Red Flags: 3 Costly B2B Collection Mistakes in Connecticut

First: waiting too long and letting disputes become “policy.” Once an invoice ages past normal terms, the story changes—and the recovery curve drops.

Second: negotiating without documentation. Verbal agreements don’t protect you when someone new steps into AP and resets the narrative.

Third: going aggressive too early. Escalation without strategy can trigger defensiveness, legal posturing, and reputational blowback—especially in tight industries along the Gold Coast.

Strategic FAQs for Connecticut B2B Owners

Will this destroy my customer relationship?

Not if it’s handled professionally. Our approach is mediation-first, focused on resolution, documentation, and payment structure—not confrontation.

What if the debtor claims “cash flow issues” but keeps buying elsewhere?

We pressure-test their story through business verification, dispute review, and credit leverage options where permitted—then propose terms that protect you.

Connecticut question: What if my customer is in Stamford but their AP team is out of state?

Common scenario. We pursue the legal entity and the actual AP decision-maker simultaneously, using multi-channel notice and escalation sequencing to prevent “remote AP limbo.”

Need a top rated CT commercial collection agency? Contact Us