Let’s be direct — hiring a collection agency is a big decision. Most businesses don’t do it lightly. It means you’ve tried to collect in-house, you’ve sent reminders, and patience has run thin. At that point, trust becomes everything.

And trust starts with transparency. We’ve heard every concern from business owners, CFOs, and office managers — and the best way to build confidence is to answer those objections head-on, not sidestep them.

Here’s a candid look at the most common objections to hiring a collection agency — and the real answers that smart businesses deserve.

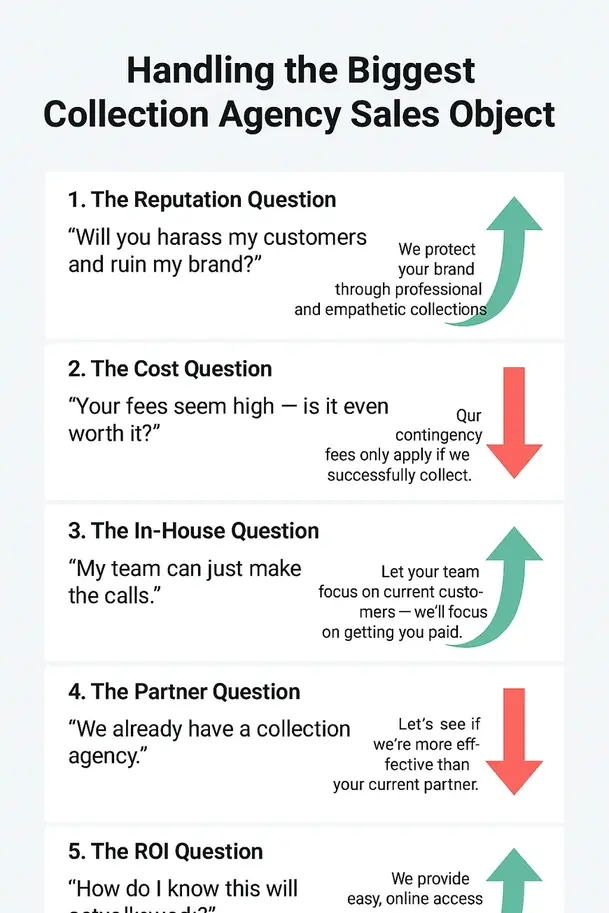

1. The Reputation Question

“Will you harass my customers and ruin my brand?”

This is the number one fear — and it’s valid. Your customers are the foundation of your business. You’ve spent years earning their trust; one wrong conversation can undo that.

The truth is, the “aggressive debt collector” stereotype is outdated. Modern agencies are relationship-focused, not confrontation-focused. Every collector on our team is trained in empathy, negotiation, and professional communication. We don’t pressure — we persuade.

We act as a polite, third-party mediator, not a threat. Our approach protects your brand, your compliance obligations, and often your relationship with the client. Especially for medical and dental offices, where HIPAA and sensitivity are paramount, we view every call as a reflection of your reputation.

A good collection agency doesn’t burn bridges; it rebuilds cash flow without damaging trust.

2. The Cost Question

“Your fees seem high — is it even worth it?”

Fair question. At first glance, a 30–40% contingency fee can seem steep. But the right way to think about it is this: What’s the cost of not collecting anything at all?

An unpaid invoice that’s been sitting for 90 or 120 days isn’t earning you interest — it’s silently costing you. The 100% you keep from uncollected debt is zero.

We only get paid when you do. That means zero risk, zero upfront cost, and potentially thousands in revenue recovered. When you factor in the hours your staff spends chasing overdue accounts — hours that could’ve gone to productive, paying work — our service doesn’t cost you money. It recovers money you were about to lose forever.

3. The In-House Question

“My team can just make the calls.”

That’s true — they can. But should they?

Your office manager, AR clerk, or billing coordinator already wears multiple hats. When they’re spending half their day chasing late payments, they’re not focusing on new revenue, active customers, or patient experience.

Collections require specialized training, skip-tracing tools, legal knowledge, and — most importantly — emotional distance. Debtors respond differently when a neutral third party calls. The dynamic shifts from “I’ll get to it later” to “I need to resolve this professionally.”

Let your team do what they do best — grow your business. Let us do what we do best — get you paid.

4. The Partner Question

“We already have a collection agency.”

Good — that means you understand the value of professional recovery. But the next question is: Are you satisfied?

Most companies have no real benchmark for how their current agency is performing. Are they recovering the right percentage? Are they compliant? Are they protecting your brand voice?

We often suggest a no-risk performance trial — what we call a second placement test. Send us a sample batch of accounts your current agency couldn’t collect. If we don’t recover anything, you’ve lost nothing. But if we outperform them, you’ll see why many businesses re-evaluate who they partner with long-term.

The best partnerships are built on results, not habit.

5. The ROI Question

“How do I know this will actually work?”

This one’s all about trust and data. You want proof — not promises.

That’s why we give our clients full visibility: real-time online reports, detailed activity logs, and recovery dashboards that show exactly where every dollar is in the process.

We also provide industry-specific benchmarks — so you can see how similar businesses in your field (medical, dental, B2B, etc.) have performed. While no agency can guarantee 100% recovery, we can show consistent, data-driven results that turn your uncertainty into confidence.

Transparency builds trust. Trust drives performance.

6. The Compliance & Legal Question (Bonus — and often overlooked)

“Will you keep us compliant and out of legal trouble?”

Absolutely — and this is non-negotiable.

Between Regulation F, TCPA, HIPAA, and state-specific consumer laws, compliance is no longer just an operational checkbox; it’s the backbone of how we collect.

A professional agency invests in ongoing legal updates, call recording, data security, and staff certification. Compliance isn’t just protection for us — it’s protection for you. When you choose a compliant partner, you’re shielding your brand from regulatory risk while maintaining a professional, ethical standard that clients appreciate.

The Bottom Line

Objections aren’t obstacles — they’re opportunities to show what kind of partner you really are.

A great collection agency isn’t just a company that chases money. It’s an extension of your accounts receivable process, your customer service values, and your brand promise.

When you hear these objections, don’t just counter them — answer them honestly. That’s how you build lasting partnerships, recover lost revenue, and turn hesitation into trust.