Understanding Time-Barred Debts: Statute of Limitations Explained

When you owe money, creditors typically have a certain period to legally pursue repayment. This legal timeframe is known as the statute of limitations. Once this period expires, the debt becomes “time-barred,” meaning creditors or collection agencies can no longer sue you to recover the debt. However, it doesn’t mean your debt completely disappears.

What Exactly is a Time-Barred Debt?

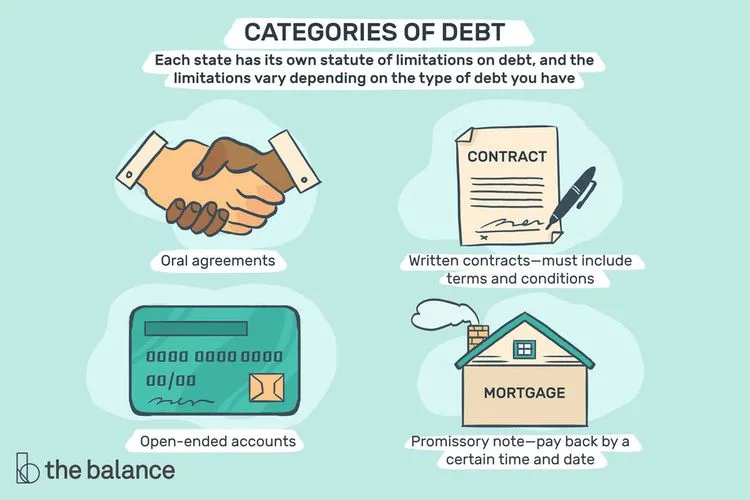

A time-barred debt is one that has surpassed the statute of limitations, preventing creditors from legally enforcing repayment through the courts. This time limit varies widely by state and debt type, generally ranging between 3 to 6 years. Once expired, creditors can still attempt collections through phone calls or letters, but you’re not obligated by law to pay.

Can Time-Barred Debt Affect Your Credit?

Yes, absolutely. Even if the statute of limitations has expired, unpaid debts may stay on your credit report for up to seven years from the date of your first missed payment. This can significantly lower your credit score, making it harder to obtain loans, credit cards, or favorable interest rates.

Statute of Limitations by State (Common Debt Types)

| State | Written Contracts | Oral Agreements | Promissory Notes | Open-Ended (Credit Cards) |

|---|---|---|---|---|

| Alabama | 6 years | 6 years | 6 years | 3 years |

| California | 4 years | 2 years | 4 years | 4 years |

| Florida | 5 years | 4 years | 5 years | 4 years |

| Illinois | 10 years | 5 years | 10 years | 5 years |

| Indiana | 10 years | 6 years | 10 years | 6 years |

| New York | 6 years | 6 years | 6 years | 6 years |

| Ohio | 8 years | 6 years | 6 years | 6 years |

| Texas | 4 years | 4 years | 4 years | 4 years |

| Washington | 6 years | 3 years | 6 years | 3 years |

(*Note: Verify with local laws or consult an attorney, as laws occasionally change.)

How Debt Becomes “Revived”

If you make a payment—even a partial one—or acknowledge the debt verbally or in writing, you risk “reviving” the debt. This resets the statute of limitations, making the debt legally collectible again. For example, paying just $20 toward a $3,000 time-barred credit card debt can restart the clock, potentially exposing you to lawsuits again.

What Should You Do if Contacted About a Time-Barred Debt?

- Avoid Admitting Debt: Never confirm the debt is yours without legal consultation.

- Request Verification: Ask for documentation proving the debt and the date of your last payment.

- Know Your Rights: Debt collectors are legally prohibited from suing or threatening to sue you on time-barred debts.

Paying a Time-Barred Debt: Should You?

Consider carefully before deciding:

- No Legal Obligation: You’re not legally required to pay once the statute expires.

- Credit Score Impact: Paying won’t remove the debt immediately from your credit report unless you negotiate a “pay-for-delete” agreement.

- Negotiate Wisely: If choosing to pay, settle for less and request the agreement in writing. For example, offering to settle a $2,000 debt for $800 could save you money and stress.

Real-Life Example:

Sarah from Texas was contacted about an old credit card debt of $5,000. The debt was 5 years old—beyond Texas’ 4-year statute for credit card debt. She confirmed the debt verbally, unintentionally restarting the statute of limitations. Now, Sarah can potentially face legal action, something avoidable had she understood her rights better.

Final Thoughts

Understanding the statute of limitations can protect your financial well-being and prevent unnecessary stress or costly mistakes. When dealing with old debts, always seek professional advice from financial counselors or attorneys to make informed decisions.

Every state sets its own time limits on collecting debts, and the rules can differ widely between medical, credit card, or written contracts. Our agency tracks these deadlines carefully so creditors never miss their legal window to recover funds.