Strategic Capital Recovery: Navigating B2B Receivables in the Green Mountain State

In Vermont’s specialized B2B landscape—stretching from the advanced manufacturing hubs in Chittenden County to the agricultural tech corridors along I-89—maintaining liquidity is as vital as the state’s rugged reputation for integrity. Whether your enterprise is anchored in Burlington’s tech scene or the industrial parks of Rutland, past-due invoices represent more than lost revenue; they represent stalled growth. At CollectionAgencyUSA.com, we specialize in high-stakes account reconciliation that honors the “Firm on Results, Fair on People” ethos.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

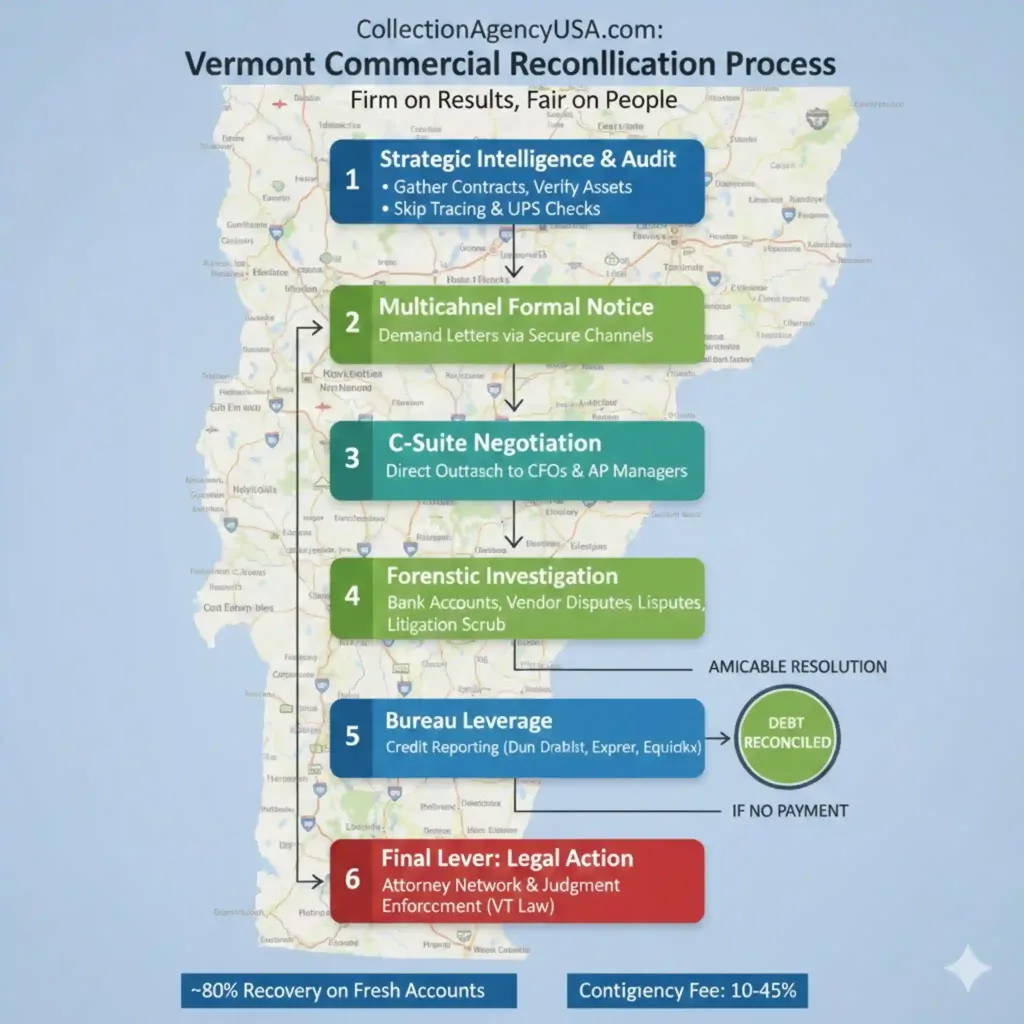

The Vermont Commercial Reconciliation Workflow

Our methodology is designed for the sophisticated B2B environment, where precision outweighs volume. We don’t just “collect”—we reconcile through a rigorous, multi-stage process:

-

Strategic Intelligence & Audit: We begin by verifying assets and auditing existing contracts. Our team utilizes advanced Skip Tracing and USPS address checks to ensure your debtor hasn’t vanished into the rural Northeast.

-

Multichannel Formal Notice: We move immediately with professional demand letters sent via multiple secure channels, establishing a clear paper trail and legal standing.

-

C-Suite Negotiation: Our senior adjusters engage directly with CFOs and AP Managers. We eschew robo-calls in favor of human-to-human dialogue, recognizing that a polite yet firm conversation is the fastest route to a wire transfer.

-

Forensic Investigation: We perform a deep-dive into bank accounts and vendor disputes. This includes a Litigation Scrub to identify high-risk debtors who make a habit of non-payment.

-

Bureau Leverage: Where permitted, we report delinquencies to Dun & Bradstreet, Experian Business, and Equifax Commercial. This non-legal lever often prompts payment from Vermont businesses looking to protect their credit standing for future expansion.

Performance-Based Alignment of Interests

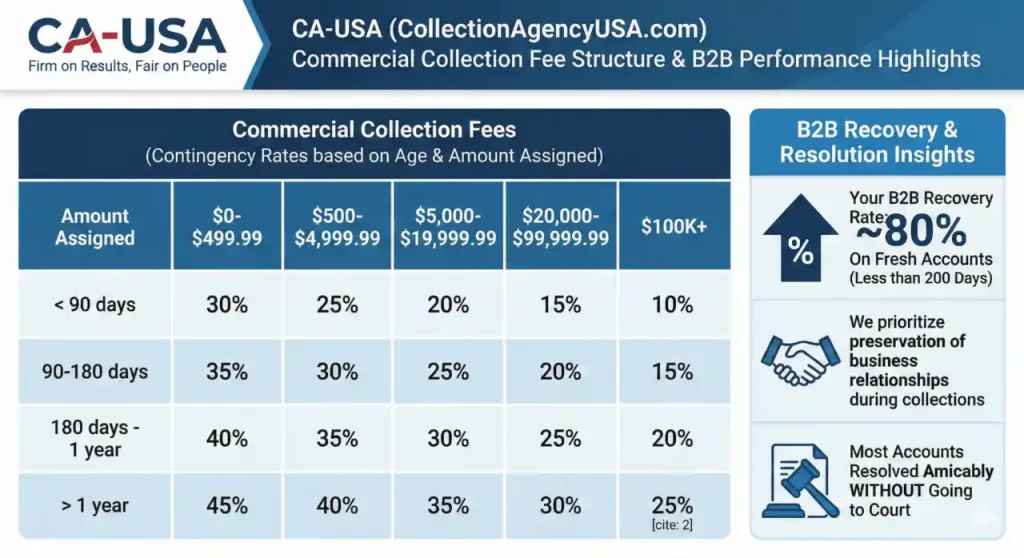

Our fee structure is built on a pure Contingency Model. We only succeed when you do. Our rates range from 10% to 45%, dictated by the balance size, the age of the debt, and the complexity of the file. To maximize your ROI, we offer our lowest rates to younger debt and higher balances. This ensures our interests are perfectly aligned with your bottom line.

The 80% Performance Advantage

Speed is the ultimate arbiter of success in commercial recovery. For “fresh” accounts—those less than 200 days past due—CA-USA achieves an ~80% recovery rate. By engaging us early, Vermont enterprises can significantly increase the probability of a full reconciliation before the debt becomes toxic.

The Red Flag Section: 3 Common B2B Mistakes in Vermont

-

Waiting for the “Check in the Mail”: In the close-knit Vermont business community, many owners wait too long out of politeness. Every day an invoice sits past 90 days, its value depreciates.

-

Incomplete Documentation: Failing to secure a signed personal guarantee or updated credit application limits your leverage when a business entity dissolves.

-

Ignoring the “Corporate Veil”: Many assume a “Closed” sign means the end. However, if the owner signed a personal guarantee or is operating as a sole proprietorship, they remain personally liable.

Legal Sophistication and Personal Assets

When mediation reaches its limit, we pivot to our national network of specialized attorneys to initiate legal action and judgment enforcement. Under Vermont law (Title 9, Chapter 63), commercial collections are distinct from consumer debt, allowing for more aggressive pursuit of business assets.

FAQ: Can we go after personal assets?

Yes, under specific conditions. If a Personal Guarantee was signed, or if the entity is a Sole Proprietorship/Partnership, the owners are personally liable. Furthermore, if we detect “fraudulent transfers”—where an owner moves money to dodge creditors—we can challenge those actions in court.

Strategic FAQs

Will this ruin my relationship with my vendor?

Rarely. We prioritize relationship preservation, acting as a third-party mediator to resolve disputes amicably. Most accounts are settled through professional negotiation without ever seeing a courtroom.

Do you handle out-of-state debtors for VT companies?

Absolutely. While you are based in Vermont, our reach is national. We track debtors across state lines using bilingual (Spanish) teams and recorded calls for total compliance and quality assurance.

Recover your Business Debts? Contact us