Oregon businesses run on tight timing—freight on I-5, suppliers along I-84, and contractors moving job-to-job across the Willamette Valley.

When invoices stall, it’s not just “late payment.” It’s a chain reaction: delayed purchasing, delayed hiring, delayed growth. If you sell B2B in Oregon, your collections approach must protect relationships while still producing results.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

Performance-Based Value (Aligned Incentives)

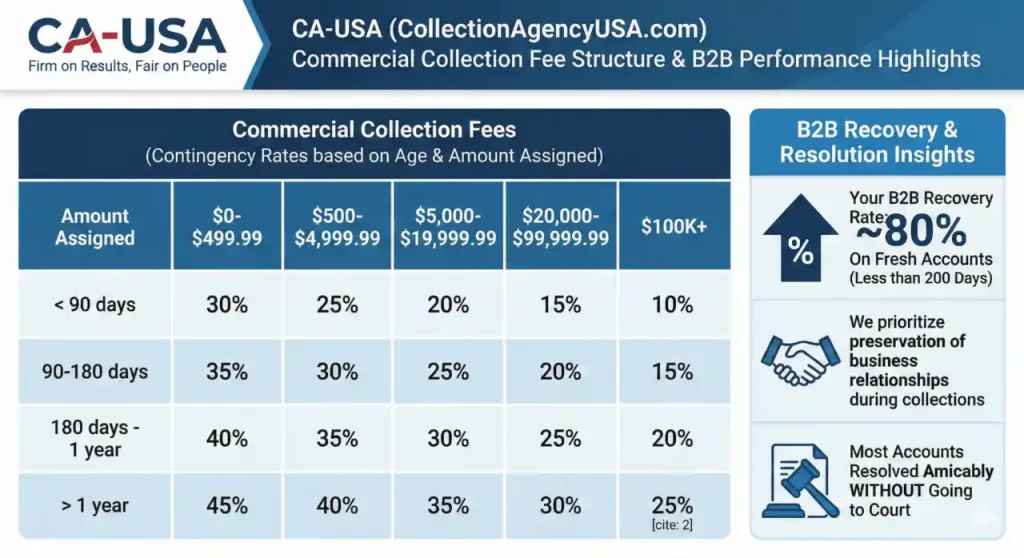

For Oregon commercial accounts, we use contingency-only pricing: typically 10% to 45%, based on balance size, age, and complexity—quoted upfront.

Higher balances and younger debt usually receive the lowest rates.

And here’s the metric that matters: we achieve ~80% recovery on fresh commercial accounts (under 200 days).

Oregon’s B2B Reconciliation Workflow (Built for Fast Resolution)

1) Intake + Evidence Pack

We gather contracts, invoices, POs, delivery proof, and communication history. Clean documentation wins.

2) Verification + Formal Notice

We confirm debtor identity, validate addresses, and send immediate demand notices through multiple channels to stop the “we didn’t see it” excuse.

3) Human-to-Human Negotiation (No Robo Calls)

We reach real decision makers—owners, CFOs, controllers, and AP managers—then structure a payment solution that closes the loop.

4) Deep-Dive Investigation

We look for dispute patterns, vendor offsets, address changes, and hidden stall tactics. We don’t argue—we diagnose.

5) Credit Reporting + Pre-Legal Review (When Needed)

Where permitted, we can report commercial non-payment to Dun & Bradstreet, Experian Business, and Equifax Commercial—a powerful lever that often changes behavior quickly.

If the account still refuses to move, we prep for pre-legal review.

6) The Final Lever: Legal Action & Judgment Enforcement

If resolution fails, we can initiate legal action through our national attorney network and move into judgment enforcement steps.

Operational Edge Across Oregon

- Bilingual (Spanish) team for smoother communication

- Recorded/reviewed calls to protect your brand and maintain professionalism

- Litigation Scrub to filter high-risk debtors before you waste time chasing ghosts

- USPS address verification, skip tracing, and bankruptcy screening to reduce dead ends

Red Flags Oregon Businesses Keep Paying For (Stop Doing These)

- Red Flag #1: Waiting too long “to be nice.”

Past-due invoices don’t get easier with time. The story hardens. The cash disappears. - Red Flag #2: Letting the debtor control the timeline.

“We’ll pay next month” turns into three months. We reset urgency with structure and deadlines. - Red Flag #3: Treating every account the same.

A contractor dispute in Bend isn’t the same as a supplier invoice stuck in Portland’s logistics loop. We tailor strategy by industry and leverage.

Local Anchors: Where Oregon Commercial Debt Gets Stuck

- Vendor invoices tied to the Port of Portland and warehousing routes

- Service agreements supporting Silicon Forest operations in Hillsboro and Beaverton

- Construction and trades working along I-205 and expanding suburbs

- Agriculture suppliers and distribution across the Willamette Valley

- University-adjacent vendors near Oregon State University and the University of Oregon

- Regional service contracts supporting fast growth in Central Oregon

Practical Legal & Compliance Notes

- Oregon and federal rules prohibit abusive or deceptive collection behavior, and we operate with strict quality controls.

- We keep outreach professional, documented, and reputation-safe—because in B2B, your next deal may come from the same network you’re trying to collect from.

- For timing: Oregon contract claims commonly operate on a six-year window—so delaying action can reduce options.

Strategic FAQs for Oregon B2B Owners

Q: Will this ruin my relationship with my customer or vendor?

A: Not with professional mediation. Most matters resolve without court because we aim for agreement, not humiliation.

Q: Can you pressure payment without going legal?

A: Yes. Structured outreach + documentation + escalation to decision-makers is often enough. Credit reporting (where permitted) adds serious leverage.

Q: What if the debtor is stalling with a “dispute” that feels fake?

A: We isolate the dispute, request proof, and remove vague excuses. If it’s a delay tactic, it collapses under documentation.

Recover your B2B debts? Contact us