South Carolina Commercial Debt Recovery: Securing Liquid Capital in the Palmetto State

From the precision manufacturing plants in the Upstate to the high-efficiency cranes at the Port of Charleston, South Carolina’s economy is a powerhouse of logistics and production. In a state that has become a national leader in advanced energy via the SC NEXUS Tech Hub, a stalled B2B invoice is more than a line item—it is a supply chain bottleneck. Whether your enterprise is fueling growth near Inland Port Greer or managing heavy industry along the I-26 corridor, your cash flow is the lifeblood of your operation, and it must remain as steady as the flow of the Savannah River.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

The 80% Performance Standard for Fresh Commercial Debt

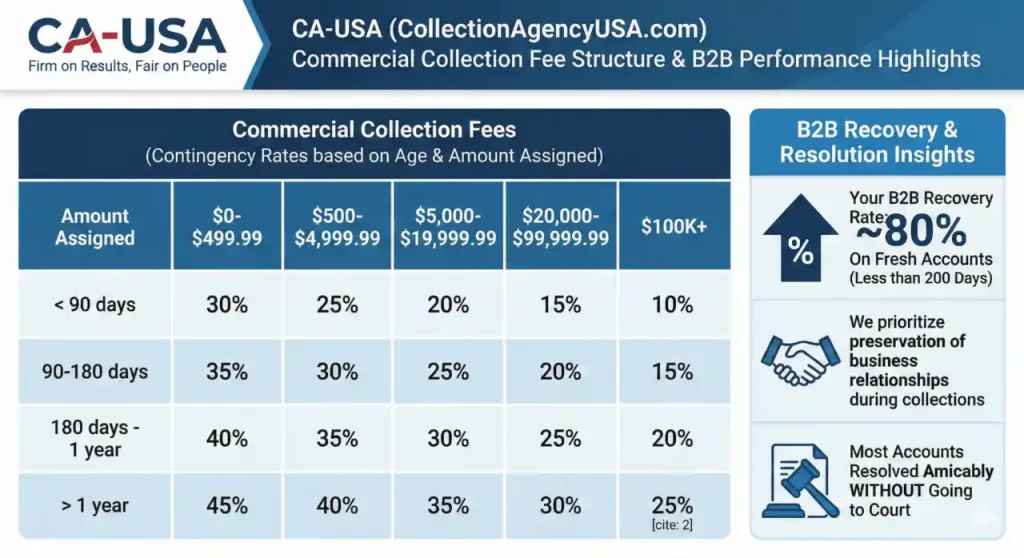

Timing is the critical variable in the world of B2B asset recovery. At CA-USA, our Account Reconciliation Team operates with a clear benchmark: we achieve an ~80% recovery rate on fresh commercial accounts that are less than 200 days past due. By intervening while the trail is still warm and the corporate relationship is still viable, we secure capital far more effectively than traditional agencies that wait for a debt to become “uncollectible.”

Performance-Based Value: Alignment of Interests

We operate exclusively on a Contingency Model, meaning we only earn our fee when we successfully put money back into your account. Our rates are transparent and communicated to you in advance, ranging from 10% to 45% depending on the balance size, the age of the debt, and the complexity of the file. To reward proactive management, higher balances and younger debt receive our lowest rates, ensuring that your most significant assets are recovered with maximum ROI.

The Commercial Reconciliation Workflow

Our B2B process is designed to be sophisticated, persistent, and respectful, following a rigorous multi-stage protocol:

-

Intelligence & Asset Audit: We begin by gathering all underlying contracts and verifying corporate assets. We perform a USPS address check and a litigation scrub to identify high-risk debtors before the first call is made.

-

Rapid Formal Notification: We issue immediate, multi-channel demand letters that signal a formal transition from a billing dispute to a reconciliation matter.

-

Executive-to-Executive Negotiation: Our strategists engage in direct outreach to CFOs and AP Managers. We avoid robo-calls in favor of sophisticated, human-to-human dialogue that resolves disputes professionally.

-

Forensic Investigation: We conduct a deep-dive check into bank accounts, vendor history, and potential internal disputes that may be stalling your payment.

-

Credit Bureau Leverage: If mediation stalls, we report the delinquency to Dun & Bradstreet, Experian Business, and Equifax Commercial. This serves as a powerful non-legal lever, as no South Carolina firm wants to jeopardize their corporate credit rating.

-

The Final Legal Lever: Should all other avenues fail, we initiate legal action via our nationwide network of attorneys—only with your explicit permission. We handle everything from the initial filing to Judgment Enforcement.

Operational Edge: Quality and Precision

We protect your professional reputation through rigorous quality controls. Our Bilingual (Spanish) Team ensures that we can navigate complex negotiations across South Carolina’s diverse industrial landscape without communication barriers. All calls are recorded for quality assurance, and we utilize a Litigation Scrub to filter out debtors who are chronically involved in legal disputes, allowing us to focus our energy on recoverable assets.

Localized Strategic Anchors

We speak the language of South Carolina industry. Our strategists are intimately familiar with the I-85 corridor manufacturing boom and the agricultural heartland near Inland Port Dillon. We understand the billing cycles of the Medical University of South Carolina (MUSC) research ecosystem and the high-tech requirements of firms operating in the Midlands. This local context allows us to approach your debtors with the authority of a peer, rather than the aggression of an outsider.

Red Flag: 3 Common B2B Collection Mistakes in South Carolina

-

The “Good Old Boy” Delay: In the Palmetto State, personal relationships are vital, but waiting too long to formalize a debt because of a “handshake agreement” often leads to a business becoming an unsecured creditor when the debtor’s cash flow dries up.

-

Ignoring the 200-Day Rule: Statistics prove that recovery rates plummet after 200 days. Treating a six-month-old invoice like a one-month-old one is a recipe for a permanent write-off.

-

Soft Contracts: Many local firms fail to include “collection cost” clauses in their master service agreements, leaving them to eat the contingency fees when they eventually have to hire an agency.

Relationship Preservation and Amicable Resolution

At CA-USA, we believe that a debtor today is often a client tomorrow. We prioritize maintaining the client-debtor relationship, resolving most accounts through amicable mediation without ever stepping into a courtroom. By acting as a neutral third party, we can often de-escalate “he-said, she-said” disputes and find a middle ground that results in payment and preserved rapport.

Strategic FAQs

Q: Will reporting my debtor to credit bureaus ruin our partnership?

A: Not necessarily. We use credit reporting as a final incentive. Often, the mere notification that we are authorized to report is enough to trigger an immediate payment from an AP department looking to protect their borrowing power.

Q: At what point do we decide to sue?

A: Legal action is our “last resort.” We will only suggest litigation if our forensic investigation proves the debtor has the assets to satisfy a judgment, and we will never move forward without your written authorization.

South Carolina Legal & Compliance Summary

Commercial debt in South Carolina is governed by distinct statutes that offer more flexibility than consumer laws, yet require strict adherence to the South Carolina Consumer Protection Code in specific mixed-use scenarios. We perform mandatory Bankruptcy Checks and Skip tracing to ensure every action is compliant. Our process is designed to protect you from “review-bombing” and legal counter-claims while ensuring your firm remains firm on results and fair on people.

Recover your B2B debts? Contact us