Ohio runs on momentum—manufacturing lines, logistics lanes, and service businesses that can’t afford cash flow surprises.

From the I-71 corridor connecting Cleveland–Columbus–Cincinnati to the Ohio Turnpike moving freight across the Midwest, payment delays ripple fast.

When invoices stall in Dayton’s aerospace orbit or near the Port of Cleveland, the fix isn’t drama—it’s disciplined reconciliation.

Red Flags Ohio Companies Keep Tripping Over

-

Waiting “one more month” because the customer usually pays. In Ohio’s fast-moving supply chain, late becomes normal quickly.

-

Letting your ops team chase money. Your project manager shouldn’t be doing collections between job sites and change orders.

-

Going nuclear too early (threats, aggression, embarrassment). That’s how relationships break—and disputes multiply.

Our Commercial Reconciliation Workflow (Built for Real-World B2B)

We don’t “harass.” We resolve—with leverage, documentation, and professionalism.

-

Deep-Dive Portfolio Assessment: We begin by auditing your contracts and mapping the debtor’s corporate assets to determine the most viable path to a full recovery.

-

Multi-Touch Validation Protocol: Immediate formal notices are dispatched via secure digital and physical channels, establishing an undeniable paper trail of the obligation.

-

Executive Mediation Strategy: We bypass the “robo-call” approach, engaging in direct, high-level negotiation with CFOs and Accounts Payable Managers. This human-to-human interaction is essential for resolving complex B2B disputes.

-

Asset & Dispute Forensics: Our team investigates hidden bank accounts and analyzes vendor disputes that may be acting as artificial roadblocks to payment.

-

The Strategic Credit Lever: We report delinquencies to the major commercial bureaus—Dun & Bradstreet, Experian Business, and Equifax Commercial. This impacts the debtor’s future creditworthiness, often prompting immediate settlement to protect their own vendor relationships.

-

Domestic Legal Escalation: If amicable mediation reaches an impasse, we initiate formal action through our expansive network of specialized litigators across the USA to secure a judgment.

| Need a Commercial Collection Agency? Contact Us Serving Hundreds of Businesses !Easy to use • Fully Compliant with Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Over 20 years Experience • Free Commercial Credit Bureau reporting • Low fee • Highly Rated ! |

Performance-Based Value (Where Our Interests Align With Yours)

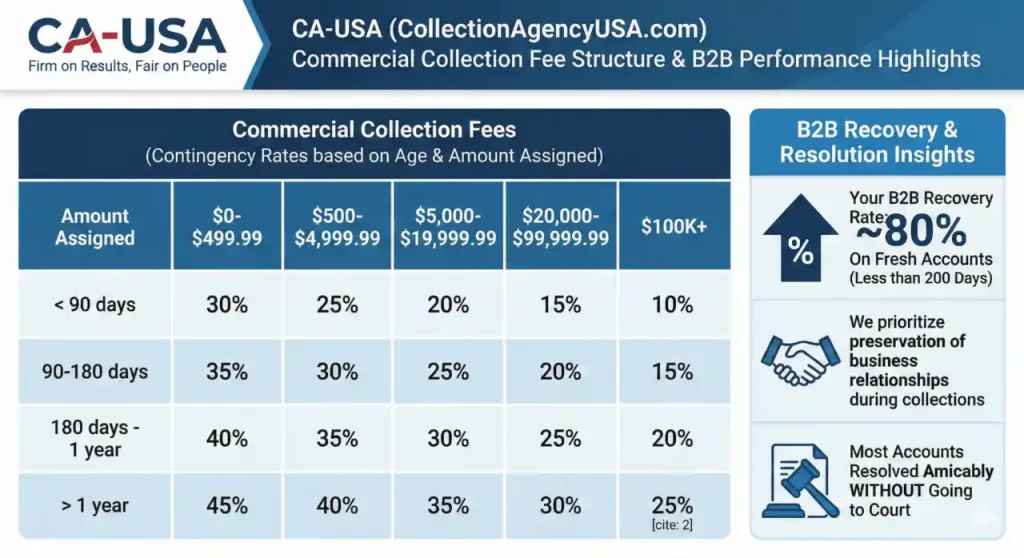

Our commercial collections are pure contingency—you only pay when money is recovered. Fees typically range 10% to 45%, based on balance size, age of the account, and complexity.

A simple rule holds: higher balances and younger accounts receive the lowest rates. Older, disputed, or hard-to-locate accounts require more work—and pricing reflects that.

If you’re sitting on fresh receivables, we bring urgency. On commercial accounts under 200 days, we average ~80% recovery. That’s not luck. That’s process, pressure, and professionalism.

The Relationship-Safe Advantage (Yes, You Can Get Paid Without Burning Bridges)

In Ohio, many industries are tight-knit. The same vendors and subcontractors cross paths again—especially across Columbus distribution networks, Toledo manufacturing lanes, and Cleveland’s industrial base.

Our approach is firm enough to secure payment, controlled enough to preserve the relationship. Most accounts resolve through structured mediation, not court escalation.

We’re not here to “win an argument.” We’re here to get the account resolved—so you can keep selling, shipping, building, and servicing.

Operational Edge: Speed, Documentation, and Quality Control

The earlier you assign an account, the more options you keep. Aging destroys leverage.

We use email and text outreach when appropriate to speed confirmations and reduce back-and-forth. We also maintain a bilingual Spanish team—a real advantage in industries where communication speed decides outcomes.

Every file runs through our Litigation Scrub to identify high-risk cases before you waste time chasing the wrong target. And for quality protection: calls are recorded and reviewed to prevent rogue behavior and protect your brand from reputation blowback.

Legal + Compliance Guardrails (Practical, Not Legal Advice)

Ohio collections require discipline. We emphasize documentation, accuracy, and clean communication.

We support resolution with USPS address verification, skip tracing, and bankruptcy checks so you’re not negotiating with outdated data. If the account demands escalation, we coordinate pre-legal review and, when necessary, initiate legal action through our nationwide attorney network—followed by judgment enforcement options.

FAQs for Ohio B2B Owners

Will this ruin my relationship with my customer or vendor?

Not if it’s handled correctly. Our process is built to stay professional, de-personalized, and solution-focused—so payments happen without public conflict.

Should I send accounts from multiple Ohio locations together?

Yes. Bundling accounts from Columbus, Cincinnati, Cleveland, or Dayton often improves speed because we can identify patterns in AP behavior and standardize resolution.

Do you handle disputed invoices (short-pays, offsets, “we never got it” claims)?

That’s where we shine. We work the dispute like a business conversation—confirm delivery, align documentation, and close the gap without turning it into a feud.