In the world’s fourth-largest sub-national economy, California businesses face a high-stakes environment where a single unpaid invoice can disrupt the entire supply chain. Whether your enterprise supports the global vessel traffic at the Port of Long Beach, fuels the innovation engine of Silicon Valley, or manages the heavy logistics along the I-5 and I-10 corridors, cash flow is your most critical asset. In a state that outpaces entire nations in economic output, you need a partner who understands that professional reputation is just as valuable as the recovered funds.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Alignment of Interests: Performance-Based Value

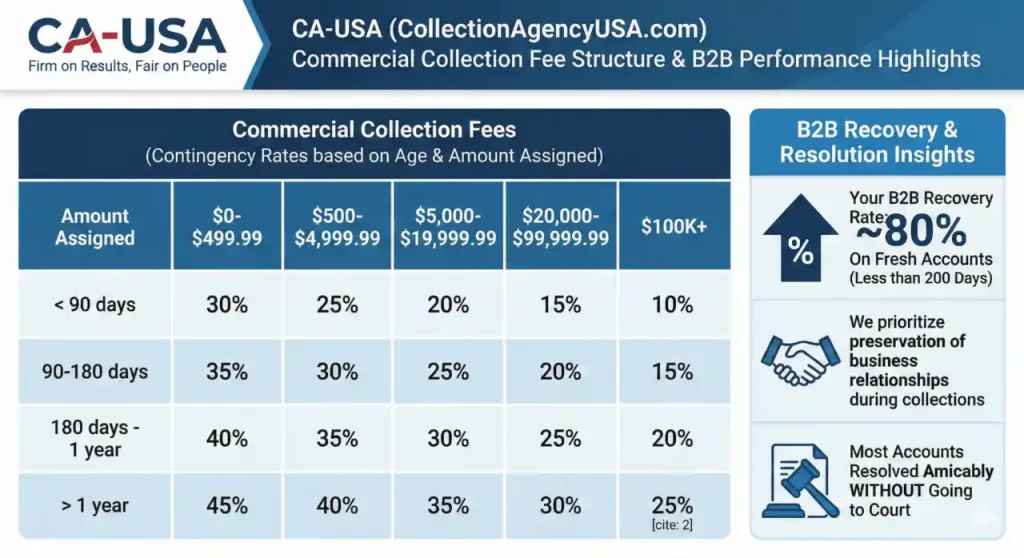

We operate strictly on a contingency-based model, ensuring our goals are perfectly aligned with yours—we only get paid when you do. Our fee structure is transparent and communicated to you in advance, typically ranging from 10% to 45%. This range accounts for the total balance, the age of the debt, and the specific complexity of the case. As a general rule, higher commercial balances and younger debts receive our lowest and most competitive rates.

The Professional Reconciliation Workflow

Our Account Reconciliation Team utilizes a sophisticated, human-centric approach to B2B recovery that far exceeds traditional collection tactics.

-

Asset Verification & Contract Audit: We begin by securing your contracts and conducting a deep-dive audit of the debtor’s corporate assets to determine a viable path to payment.

-

Strategic Multi-Channel Notice: Immediate, formal demand letters are dispatched via several secure physical and digital channels to establish an undeniable paper trail.

-

Direct Executive Engagement: We skip the robo-calls to speak directly with CFOs and Accounts Payable Managers. Professional, human-to-human negotiation is the key to resolving complex B2B disputes.

-

Financial Discovery & Dispute Analysis: Our specialists investigate the debtor’s bank accounts and research any vendor disputes that may be acting as a delay tactic.

-

Credit Bureau Influence: If initial mediation fails, we leverage reporting to major business credit bureaus, including Dun & Bradstreet, Experian Business, and Equifax Commercial. This powerful non-legal lever impacts the debtor’s future creditworthiness, often prompting immediate settlement.

-

The Final Lever: Should all amicable efforts fail, we initiate formal legal action through our expansive network of specialized attorneys across the USA to secure your judgment.

| Need a Commercial Collection Agency? Contact Us Serving Hundreds of Businesses !Easy to use • Fully Compliant with Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Over 20 years Experience • Free Commercial Credit Bureau reporting • Low fee • Highly Rated ! |

Operational Edge & California Compliance

Operating in California requires a deep understanding of evolving regulations, such as the Rosenthal Act expansion (effective July 2025), which now includes certain small business debts under $500,000. We handle the heavy lifting of compliance by utilizing USPS address checks, comprehensive Skip tracing, and Bankruptcy checks to ensure we are pursuing the correct entities. Our Litigation Scrub identifies high-risk, “professional” debtors before you waste resources on them. Additionally, our Bilingual (Spanish) Team ensures we can bridge any communication gap, with all calls recorded for your quality assurance.

Relationship Preservation: Firm on Results, Fair on People

We understand that a debtor today might be a necessary vendor tomorrow. Our philosophy focuses on cooperative mediation, resolving the vast majority of accounts without court intervention. This preservation-first approach is highly effective: we achieve an ~80% recovery rate on fresh commercial accounts that are assigned within our optimal 200-day window.

Red Flags: 3 Common B2B Collection Mistakes in California

-

Waiting Too Long: In the fast-moving tech and agriculture sectors, waiting more than 90 days significantly reduces the chance of full recovery.

-

Lack of a Written Credit Policy: Failing to segment high-risk clients before extending credit often leads to ballooning past-due reports.

-

Inconsistent Follow-Up: Relying on a single person to handle collections as a “side job” leads to missed deadlines and lost leverage.

Strategic B2B FAQs

Will this ruin my relationship with my vendor?

No. Our mediation-first strategy is designed to resolve financial disputes professionally. By acting as a third-party “reconciliation team,” we take the heat out of the conversation, often allowing the business relationship to continue once the balance is cleared.

What is the Statute of Limitations in California?

For written commercial contracts, you generally have four years from the date of the breach to file a lawsuit. However, the earlier you act, the lower your contingency fee and the higher the likelihood of success.