Texas is a global economic titan, built on the grit of the Permian Basin’s energy fields and the high-tech innovation of Austin’s Silicon Hills. In a state where business moves as fast as the freight along the I-35 and I-10 corridors, a stalled invoice is more than a line item—it is a bottleneck for your entire operation. Whether your enterprise is moving massive tonnage through the Port of Houston or managing complex healthcare contracts within the Texas Medical Center, maintaining a clean ledger is the primary directive for remaining “Texas Strong” in the current market.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Alignment of Interests: Performance-Based Value

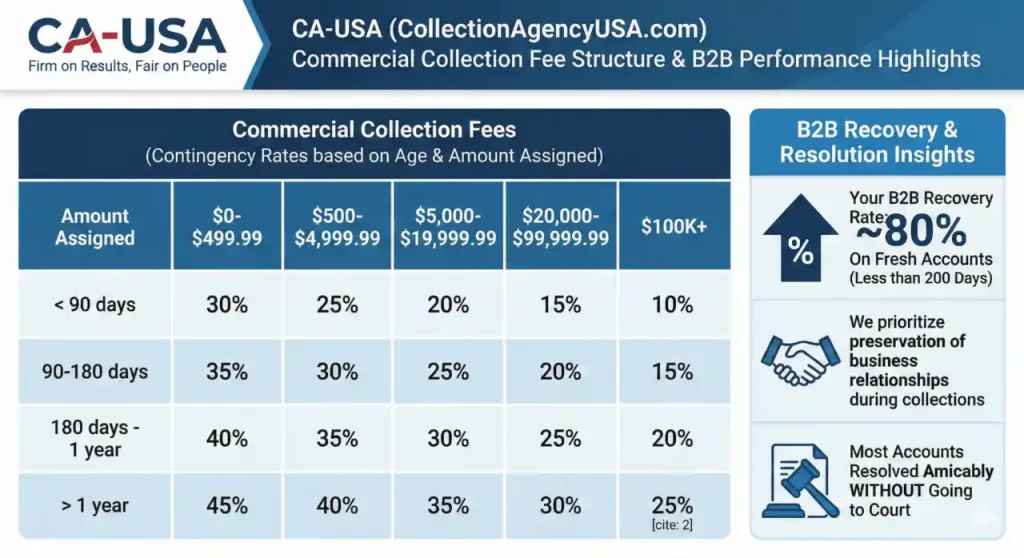

Our Account Reconciliation Team operates exclusively on a contingency-based model, ensuring our goals are perfectly synchronized with your bottom line. We provide full pricing transparency upfront, with fees ranging between 10% and 45% depending on the total balance, the age of the debt, and the specific complexity of the case. In every scenario, we prioritize rewarding proactive clients; higher commercial balances and younger debts consistently receive our lowest, most competitive rates.

The Workflow: Reconciling Professional Balances

We replace traditional, aggressive tactics with a sophisticated, multi-stage recovery process tailored for the Texas business environment.

-

Deep-Dive Portfolio Assessment: We begin by auditing your contracts and mapping the debtor’s corporate assets to determine the most viable path to a full recovery.

-

Multi-Touch Validation Protocol: Immediate formal notices are dispatched via secure digital and physical channels, establishing an undeniable paper trail of the obligation.

-

Executive Mediation Strategy: We bypass the “robo-call” approach, engaging in direct, high-level negotiation with CFOs and Accounts Payable Managers. This human-to-human interaction is essential for resolving complex B2B disputes.

-

Asset & Dispute Forensics: Our team investigates hidden bank accounts and analyzes vendor disputes that may be acting as artificial roadblocks to payment.

-

The Strategic Credit Lever: We report delinquencies to the major commercial bureaus—Dun & Bradstreet, Experian Business, and Equifax Commercial. This impacts the debtor’s future creditworthiness, often prompting immediate settlement to protect their own vendor relationships.

-

Domestic Legal Escalation: If amicable mediation reaches an impasse, we initiate formal action through our expansive network of specialized litigators across the USA to secure a judgment.

| Need a Commercial Collection Agency? Contact Us Serving Hundreds of Businesses !Easy to use • Fully Compliant with Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Over 20 years Experience • Free Commercial Credit Bureau reporting • Low fee • Highly Rated ! |

Texas Red Flags: 3 Common B2B Collection Mistakes

-

Underestimating “Texas-Sized” Delays: In the fast-moving logistics and energy sectors, an invoice that is 90 days past due is already at risk. Procrastination is the enemy of recovery.

-

Lacking a Litigation Scrub: Attempting to collect from “professional debtors” without checking their legal history can lead to counter-suits and reputation damage.

-

Fragmented Documentation: Many Texas firms fail to secure signed proof-of-delivery or master service agreements (MSAs) before a dispute arises, weakening their leverage during mediation.

Operational Edge & Lone Star Compliance

Navigating the Texas Debt Collection Act (TDCA) requires a partner who understands the nuances of state-specific regulations. We handle the heavy lifting of compliance by utilizing USPS address checks, advanced Skip tracing, and Bankruptcy checks. To protect your brand, our Bilingual (Spanish) Team ensures we can bridge any communication gap within the Texas market, with all calls recorded and reviewed for quality assurance.

Relationship Preservation: Firm on Results, Fair on People

In a state where your reputation is your handshake, burning bridges is not a viable business strategy. Our philosophy focuses on amicable mediation, resolving the vast majority of accounts without court intervention. By treating the debtor with professional respect, we secure your funds while leaving the door open for future collaboration. This preservation-first approach is highly effective: we achieve an ~80% recovery rate on fresh commercial accounts assigned within our optimal 200-day window.

Strategic B2B FAQs

Will reporting a debt to D&B or Experian actually help?

Yes. For Texas B2B entities, a negative mark on a commercial credit report can freeze their ability to secure equipment financing or favorable terms with other suppliers, making it a powerful non-legal incentive.

Is there a limit on how much you can recover?

We handle everything from small-business disputes to multi-million dollar corporate settlements. Our contingency rates scale with the complexity and volume of the debt assigned.