Reclaiming Capital in the Innovation State: A Washington B2B Masterclass

From the precision-engineered aerospace clusters in Evergreen and Snohomish County to the automated sorting lines of Kent Valley logistics, Washington’s B2B economy is built on high-velocity contracts. In a landscape where “Net-30” often stretches into “Net-Never,” a stalled invoice is more than a delay—it’s a disruption to the very innovation that defines the Pacific Northwest. At CA-USA, we don’t just “collect”; our Account Reconciliation Team acts as a sophisticated extension of your accounts receivable, ensuring your cash flow is as steady as the current in the Columbia River.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

Performance-Based Value: Our Alignment of Interests

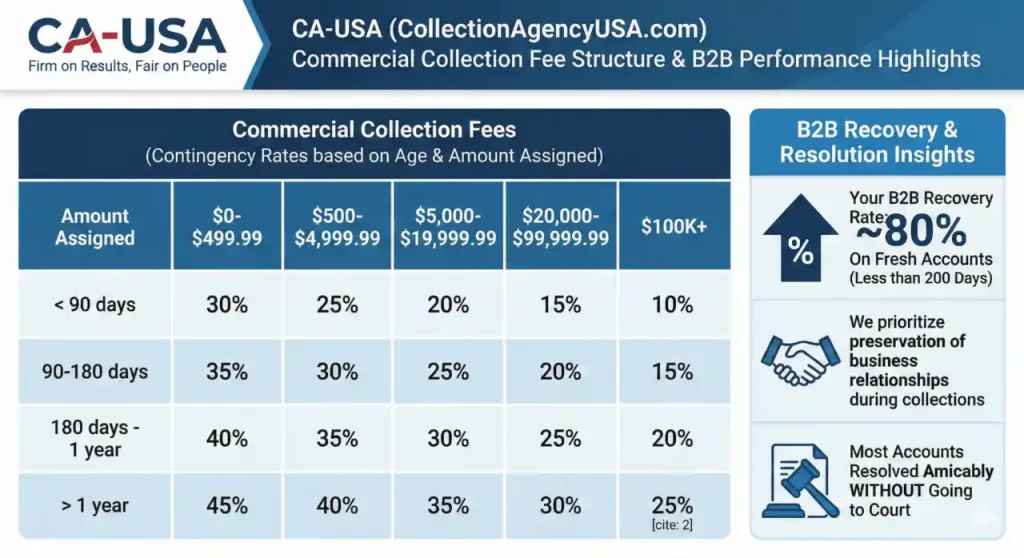

We operate on a pure Contingency Model. Our fee ranges between 10% to 45% depending on the balance, age, and complexity of the case. We prioritize transparency: higher balances and younger debt receive our lowest rates, incentivizing early assignment. If we don’t recover your funds, you owe us nothing. This model ensures our team is as invested in your bottom line as you are.

The 80% Performance Stat

In Washington’s competitive tech and maritime sectors, speed is the ultimate lever. We achieve an ~80% recovery rate on fresh commercial accounts (those less than 200 days old). Once a debt crosses the 200-day threshold, the probability of recovery in the B2B world begins to plummet. Early intervention by our specialists is the difference between a reinvested profit and a tax write-off.

Three Red Flags in Washington B2B Debt

-

The “Silent” Vendor: In the tight-knit supply chains of Bothell’s Life Science corridor, a sudden silence from a long-term partner often signals a liquidity crisis.

-

The Dispute as a Delay Tactic: Debtors often cite “Quality of Service” issues only after a payment is late. We identify these fabrications early through deep-dive contract verification.

-

Missing the “Evergreen” Deadline: Washington’s Statute of Limitations on written contracts is 6 years (RCW 4.16.040). Waiting until the final year makes skip-tracing and asset location significantly more difficult.

The Commercial Reconciliation Workflow

We replace aggressive “street-level” tactics with corporate-grade mediation.

-

Consultation & Intel: We analyze your contracts, purchase orders, and proof of delivery to build an unshakeable case.

-

Verification & Formal Notice: We issue multi-channel notices that command attention without damaging your professional reputation.

-

Human-to-Human Negotiation: We bypass front-desk gatekeepers and engage directly with CFOs and AP Managers. No robo-calls; only professional, bilingual (Spanish/English) mediation.

-

Deep-Dive Investigation: We leverage USPS address checks, Skip tracing, and Bankruptcy scrubs to find hidden assets or shell company maneuvers.

-

The Credit Lever: When permitted, we report delinquencies to Dun & Bradstreet, Experian Business, and Equifax Commercial, impacting the debtor’s ability to secure future credit.

-

The Final Lever: If mediation fails, we utilize our nationwide network of attorneys for Judgment Enforcement, ensuring no stone is left unturned.

Strategic Relationship Preservation

In a state home to giants like Amazon, PACCAR, and Microsoft, burning bridges is bad for business. Most accounts are resolved amicably through our mediation. By acting as a third-party “Account Reconciliation Team,” we remove the friction from the transaction, allowing you to maintain your client relationship while we secure your capital.

Washington Legal & Quality Guardrails

We strictly adhere to the Washington Collection Agency Act (RCW 19.16). Our operations include rigorous litigation scrubs to identify high-risk accounts and protect you from “review-bomb” risks. All calls are recorded and reviewed for quality assurance, ensuring our “Firm on Results, Fair on People” brand identity is maintained in every interaction.

FAQs

Can you collect from a company that has closed its doors?

If there was a Personal Guarantee or if assets were illegally transferred, we can often pursue the principals directly through our legal network.

How does this affect my relationship with a key vendor?

Professional reconciliation often clears the air. Many “unpaid” invoices are actually administrative errors; we solve the puzzle so the relationship can continue.

Recover your Business Debts? Contact us