In the world of B2B commerce, an unpaid invoice is more than a line item; it is a breach of trust and a drain on your working capital. When searching for a collection partner, many business owners make the mistake of looking at the lowest percentage first. However, in commercial recovery, cost is not the same as value. If you hire a “budget” agency that recovers 20% of your debt at a 10% fee, you’ve lost far more than if you hired a premium firm that recovers 80% at a 25% fee. Here is the definitive guide on how to evaluate a recovery partner and why the Collection Agency USA (CA-USA) model is the industry benchmark.

Need a Commercial Collection Agency? Contact us

1. The Slabbed Contingency Model: Performance Over Promises

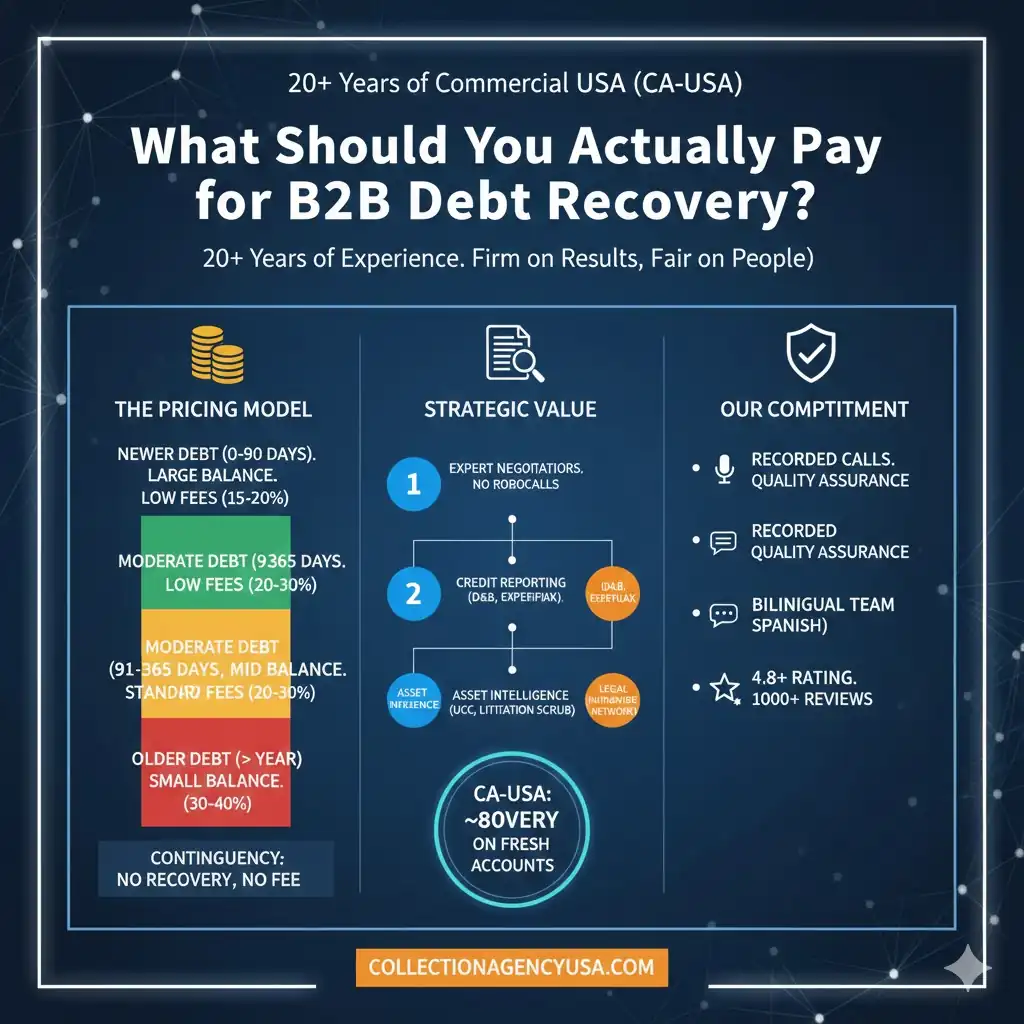

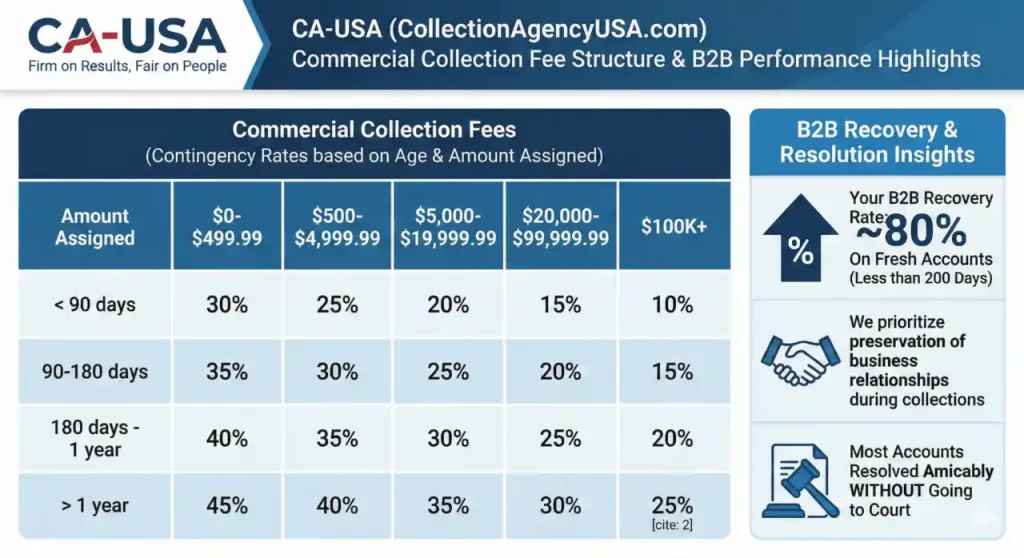

The most effective pricing structure is a flexible, slabbed contingency model. You should never pay a flat fee. A professional agency’s effort is tied to the complexity of the case, and your costs should reflect that.

-

The “Freshness” Discount: For newer accounts (under 90 days) with large balances, you should expect rates as low as 15%. These are often resolved through professional reconciliation.

-

The Complexity Adjustment: Older accounts (over 1 year) or small balances (under $10k) require intensive forensic work, skip-tracing, and persistent negotiation. These may scale up to 40%.

-

The CA-USA Fit: We operate on a pure No Recovery, No Fee basis. There are zero onboarding costs or annual “membership” fees. We win only when you do, aligning our interests perfectly with your cash flow.

2. Beyond the Robo-Call: Protecting Your Reputation

Cheap agencies rely on volume—automated calls and aggressive scripts that can permanently torch your vendor relationships. In the B2B world, the “Firm on Results, Fair on People” approach is vital.

-

The Human Element: You need senior adjusters who can speak “C-Suite.” A direct outreach to a CFO or an AP Manager often yields results that a series of letters never will.

-

The CA-USA Fit: We act as your Account Reconciliation Team. Our process is sophisticated, using human-to-human negotiation to preserve your professional reputation while ensuring the debt is prioritized.

3. Strategic Levers: Credit Reporting & Asset Intelligence

A collection agency shouldn’t just be a “loud voice.” It should be an intelligence hub.

-

Commercial Bureau Reporting: The ability to report to Dun & Bradstreet, Experian Business, and Equifax Commercial is a powerful non-legal lever. Most businesses will settle immediately to avoid a permanent stain on their credit profile.

-

Asset Logic: You need an agency that performs UCC filing visibility checks and litigation scrubs. Why waste time on a debtor who already has five judgments against them?

-

The CA-USA Fit: We utilize every non-legal tool available, from deep-dive asset searches to commercial credit reporting, ensuring we have maximum leverage before ever mentioning a courtroom.

4. Handling Disputes and “The Personal Guarantee”

Many debtors use “disputes” as a stall tactic. A great agency investigates these claims forensically rather than just walking away.

-

Personal Liability: If the debtor signed a Personal Guarantee, or if they operate as a Sole Proprietorship, the owner is personally on the hook.

-

The CA-USA Fit: Our legal team and expert collectors are trained to “pierce the corporate veil” when necessary. If money has been moved to dodge creditors (fraudulent transfer), we have the resources to challenge it.

5. Flexibility and Control: The Fine Print

You should never feel “locked in” to an agency that isn’t performing.

-

Recall Terms: If your customer calls you directly to pay after you’ve placed the account, you should have the right to recall it. Clear communication on recall fees and “lock-in” periods is the hallmark of an honest agency.

-

The CA-USA Fit: We offer transparent cancellation and recall terms. We believe our ~80% recovery rate on fresh accounts is the only “contract” we need to keep our clients loyal.

6. Institutional-Grade Security & Compliance

In an era of rising cyber threats, how an agency handles your sensitive financial data is just as important as how they handle the debt.

-

Bank-Level Encryption: Your data must be protected by end-to-end encryption both at rest and in transit.

-

GLBA Compliance: As a financial services partner, your agency must strictly adhere to the Gramm-Leach-Bliley Act (GLBA) to ensure the privacy and protection of non-public personal information. This is the same level of security that your bank should possess.

-

The CA-USA Fit: We provide a secure, encrypted client portal for seamless account placement and real-time reporting. Our infrastructure is fully compliant with GLBA and FCPA standards, ensuring that your company’s data—and your debtor’s information—is managed within a fortress of digital security. We have a dedicated compliance officer and a a full time digital security expert.

Why CA-USA is the Industry Gold Standard

With over 20 years of dedicated commercial collection agency experience and a 4.8+ rating with over 2,000+ verified reviews, CA-USA doesn’t just collect debt; we provide a strategic advantage.

We offer:

-

Bilingual Support (Spanish) for a globalized economy.

-

Recorded Calls for total quality assurance and compliance.

-

A Nationwide Legal Network for when mediation reaches its limit and judgment enforcement becomes necessary.

Stop chasing invoices and start growing your business. Let the experts at Collection Agency USA handle the reconciliation while you focus on the next deal.

Recover your Business Debts? Contact us