New Jersey B2B Debt Recovery: Securing the Logistics and Pharma Corridors

From the high-velocity shipping lanes of the Port Newark-Elizabeth Marine Terminal to the “Medicine Chest of the World” pharmaceutical hubs along the NJ Turnpike, New Jersey’s B2B landscape is defined by speed and interconnectivity. In a state that serves as the “Crossroads of the East,” a stalled invoice doesn’t just impact your ledger; it creates a bottleneck in the regional supply chain. As a leading commercial collection agency, CA-USA (CollectionAgencyUSA.com) understands that whether you are operating out of the Rutgers Discovery Frontier or managing logistics along I-95, your capital must remain fluid to remain competitive.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent B2B collection results.

Need a Commercial Collection Agency? Contact us

The Commercial Reconciliation Workflow

At CA-USA, we operate as a sophisticated collection agency specializing in the New Jersey corporate climate. We reconcile accounts through a rigorous, eight-stage protocol:

-

Phase 1: Asset Intelligence & Audit: We begin by scrutinizing contracts and conducting deep-dive asset verification. Our team utilizes USPS address checks and advanced skip tracing to ensure we are targeting the correct corporate entity.

-

Phase 2: Accelerated Formal Demand: We issue immediate, multi-channel notices that signal a transition from a standard billing dispute to a formal commercial collection agency intervention.

-

Phase 3: Executive-Level Mediation: Our Account Reconciliation Team engages in direct, human-to-human outreach. We speak the language of CFOs, utilizing our Bilingual (Spanish) Team to ensure no communication barriers exist in New Jersey’s diverse industrial sectors.

-

Phase 4: Forensic Financial Investigation: We conduct a Litigation Scrub and Bankruptcy Check to identify high-risk debtors. This involves checking bank account health and investigating potential vendor disputes.

-

Phase 5: Disputes & Rebuttals Resolution: We act as a neutral arbiter to dismantle stall tactics. By identifying the root cause of non-payment—whether a shipping error at a Jersey City warehouse or a clerical error—we move the account toward resolution.

-

Phase 6: The Credit Lever: If initial mediation stalls, we report non-payment to Dun & Bradstreet, Experian Business, and Equifax Commercial, creating a powerful non-legal incentive for the debtor to protect their own borrowing power.

-

Phase 7: Pre-Legal Asset Discovery: Before any courtroom steps are taken, we perform a final deep-scan for tangible assets, such as real estate or equipment, ensuring that a future judgment is actually collectible.

-

Phase 8: Strategic Enforcement & Judgment Recovery: As an absolute last resort and only with your explicit permission, we activate our local New Jersey legal network. Unlike a standard collection agency that stops once a gavel hits the desk, we maintain relentless pressure post-verdict. We initiate Judgment Enforcement, following through until the court’s decision translates into liquid cash in your account.

Performance-Based Value: Alignment of Interests

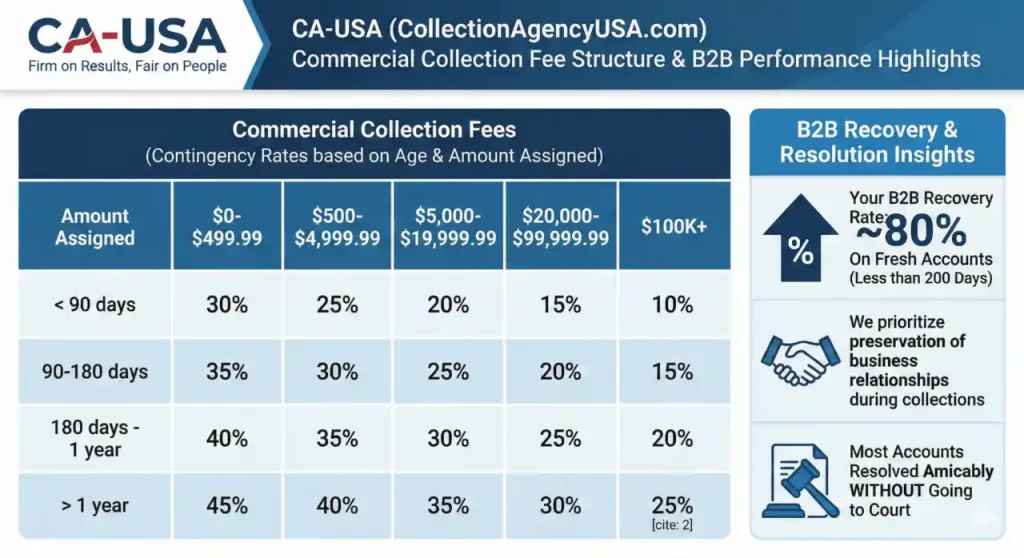

Our “Firm on Results, Fair on People” philosophy is backed by a transparent, contingency-only pricing model. At CA-USA, we are on the same team. Because our fee is tied directly to your success, we are fully invested in your recovery. To move things forward with maximum speed and seriousness, we ask that you share all contracts and communication proofs promptly; the more data we have, the faster we can pressure the debtor.

Our fees range from 10% to 45%, dictated by the balance size, the age of the debt, and the complexity of the case. By design, higher balances and younger debt receive our most competitive rates.

The 80% Performance Edge

Timing is the single greatest predictor of success in the commercial collection agency industry. We take pride in our 80% recovery rate on fresh commercial accounts (less than 200 days past due). By intervening before a debt “ages out,” we maximize the likelihood of a full recovery while minimizing the need for heavy-handed legal tactics.

Red Flags: 3 B2B Collection Mistakes in New Jersey

-

Ignoring the “Pharma-Lag”: Many NJ firms allow BioTech or Medical suppliers to stretch terms indefinitely. In the fast-moving Garden State economy, waiting 120 days to escalate often means your debtor has already moved on to a new primary vendor.

-

Lack of Bilingual Outreach: With New Jersey’s massive international trade presence, failing to provide bilingual communication can lead to “lost in translation” disputes that stall payments for months.

-

Soft Contracts: NJ courts favor clear, written terms. Relying on “handshake” agreements or vague POs without clear late-fee clauses weakens your leverage during the reconciliation phase.

Preserving the Professional Relationship

We understand that a debtor today may be a vital partner tomorrow. Our approach prioritizes mediation. Most accounts are resolved through sophisticated negotiation, keeping you out of the courtroom and preserving your reputation within the Telecommunications and Advanced Manufacturing communities.

Strategic FAQs

Q: Will this ruin my relationship with my vendor? A: No. Our sophisticated, corporate-tone mediation often resolves “misunderstandings” rather than just “debts,” frequently resulting in a cleared balance and a restored business relationship.

Q: Is legal action a requirement? A: Absolutely not. Legal action is a final tool used only if mediation fails and only after you provide explicit written consent.

New Jersey Legal & Compliance Summary

Commercial debt in New Jersey is governed by specific state statutes that differ from consumer protections. While New Jersey does not require a specific “Collection Agency License” for B2B-only firms, we maintain strict compliance with the New Jersey Consumer Fraud Act and utilize recorded calls for quality assurance. Our process includes mandatory Bankruptcy Checks to ensure we are not violating automatic stays, protecting your firm from potential counter-suits.