In the Current Florida economy, “waiting for payment” is a silent tax on your growth. From the booming construction sectors in Orlando to the dense medical corridors of Miami, the Sunshine State moves faster than the national average—and so should your cash flow.

Navigating the Florida Consumer Collection Practices Act (FCCPA) is a high-stakes chess match; one wrong move can turn a legitimate debt into a legal liability. CollectionAgencyUSA (CA-USA) provides a professional, reputation-safe recovery engine that prioritizes your brand while ensuring every dollar owed is returned to your ledger. With over 2,500 reviews and a 4.85/5 star rating, we are the trusted partner for Florida’s medical and business leaders.

Need a Collection Agency? Contact us

Disrupting the Model: $15 vs. Contingency

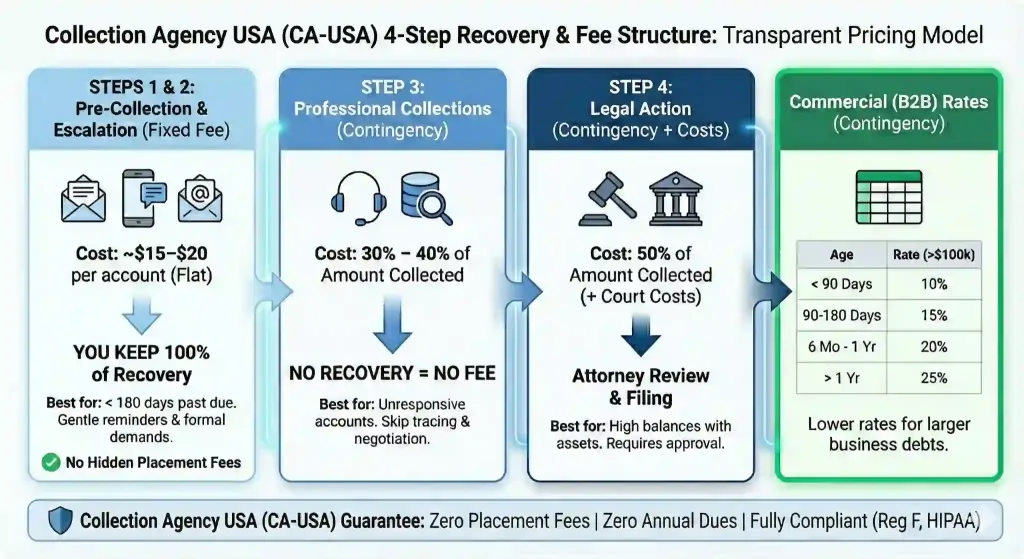

We offer a transparent, dual-track system that puts you in control of your margins:

-

The $15 Flat-Fee Disruptor: For just $15 per account, we launch a professional recovery phase. The best part? All money recovered is paid directly to you. You keep 100% of the principal with zero commission taken.

-

Performance Contingency (20%–40%): For aged or difficult accounts, we work on a “No Recovery, No Fee” basis. We only earn our commission when we successfully put money back in your pocket.

The Florida “Rules of Engagement”: Current Data

To lead in Florida, you must navigate specific legal triggers that local courts and the Attorney General prioritize.

| Law / Metric | Current Threshold / Rule | Strategic Impact |

| Medical Refund Rule (SB 1808) | 30-Day Hard Deadline | Licensed Florida providers must refund overpayments within 30 days of determination. We reconcile your accounts to prevent $500/day fines. |

| Judgment Interest Rate | 8.44% per annum | Effective January 1, Current, this is the statutory rate for unpaid judgments. We ensure you capture the full value of your debt. |

| Email Quiet Hours (SB 232) | Allowed 24/7 | Unlike phone calls, Florida now explicitly allows email communication during the 9 PM – 8 AM window, giving us a vital edge in B2B outreach. |

| Statute of Limitations | 5 Years (Written) / 4 Years (Oral) | The “clock” moves fast in Florida. Delaying collection past these points can permanently forfeit your right to payment. |

Recent Florida Recovery Results

-

Medical Specialty (Tampa): A patient balance of $9,150 was recovered in 19 days using our $15 Flat-Fee diplomatic sequence. Net to Client: $9,135.

-

Commercial Restoration (Jacksonville): Successfully recovered a $14,400 delinquent B2B invoice from a property group through intensive mediation. Net to Client: $11,520 (on 20% contingency).

Why Businesses Choose CA-USA

We provide a 100% reputation-safe environment, acting as a professional extension of your office.

-

Fully Licensed: Equipped with all 50-state collections licenses to track debtors who move across state lines.

-

Zero Onboarding Fees: No setup costs, no subscription traps, and no hidden “file fees.”

-

Premium Tools Included: We offer free credit reporting, free litigation, and free bankruptcy scrubs to ensure we are only pursuing collectible accounts.

-

Top-Tier Security: We are SOC 2 Type II, FDCPA, and HIPAA compliant, ensuring your data and your patients’ privacy are protected.

Specialized Florida Industries

-

Healthcare & Medical: 100% HIPAA-compliant recovery. we manage the Current SB 1808 overpayment mandates so you can focus on patient care.

-

Construction & Trades: From HVAC and electrical to pool contractors and restoration. We align our recovery with your “Notice to Owner” (NTO) timelines.

-

B2B Commercial & Logistics: We pressure CFOs and procurement offices without burning the account, ensuring your “net-30” invoices are prioritized.

-

Dental & Orthodontics: Maintaining patient rapport while securing payment for high-value procedures and specialty dental work.

-

Education (K-12 & Higher Ed): Tailored recovery for Florida’s growing charter school sector, balancing firm tactics with student relationship management.

-

Professional Services: Assisting Accountants, CPA firms, and Banks in recovering professional fees and overdrawn balances with diplomatic precision.

Frequently Asked Questions

Q: How does the new SB 1808 law affect my medical practice?

A: It mandates that any overpayment determination must be refunded to the patient within 30 days. We help reconcile these credits during the collection process to keep you compliant.

Q: Can I collect from a debtor who moved out of Florida?

A: Yes. Because we hold licenses in all 50 states, we can legally pursue your debt wherever the debtor relocates, adhering to both Florida and the destination state’s rules.

Q: Is the $15 fee really the only cost for the first phase?

A: Yes. There are zero onboarding or hidden fees. It is the most cost-effective way to “clean” your A/R before moving to contingency.

Q: When do you switch from flat-fee to contingency?

A: Typically, we recommend the $15 Flat-Fee phase for accounts less than 90–120 days past due. If the debtor remains unresponsive after our initial intensive demand sequence (usually 30–60 days), we can seamlessly escalate the account to our contingency “Phase II” for more aggressive, hands-on recovery efforts.

Q: Do you litigate, and when does that make sense?

A: Yes. This makes sense for balances between $5,000 and $15,000+ where our skip-tracing confirms the debtor has seizable assets or steady employment. We only recommend litigation when the “Probability of Collection” is high, ensuring your time isn’t wasted. Litigation is not a straightforward or a quick process, and it also increases chances of a counter lawsuit, so no point in rushing into it. Only if the balance is high and your supporting documentation is super solid, only then our legal department recommends a suit.

Ready to secure your revenue?

Contact CollectionAgencyUSA to launch your custom Florida recovery strategy today.

✅ Florida Internal Billing & Compliance Checklist1. Medical Overpayment Protocol (SB 1808 – Effective Jan 1, Current)

2. Communication Timing (SB 232 Rules)

3. Prohibited “Red Flag” Practices

4. Documentation & Dispute Handling

5. Record Retention

Note: We are not attorneys, but this is per our best understanding. Do cross-check these facts before finalizing your strategy. |