Across industries, late-paying business customers are more common than most owners like to admit. Many studies show that around half of all B2B invoices are paid late, and roughly 8–10% of credit-based sales eventually get written off as bad debt. Average DSO keeps creeping up, quietly draining cash flow and pushing companies toward expensive borrowing just to cover routine expenses.

Handled early and systematically, those same overdue accounts can easily deliver a recovery rate close to 80% on fresh placements (Preferably less than eight months old, backed by adequate documentation). Left to age, they turn into permanent losses and distractions. That gap between “paid” and “written off” is exactly where CA-USA’s B2B commercial debt recovery services operate.

Ready to assign your overdue accounts? Connect with us now

CA-USA’s approach is straightforward: high recovery, low noise, reputation protected, and court only when it truly makes business sense.

We are a collection agency. This is what our agents do all day long—they have the patience, persistence, skill, and every tool in their toolkit to get your payment recovered. Our commercial collectors work on a contingency basis and get paid only when they successfully collect for you. No recovery means no fee charges to you.

Why B2B Commercial Debt Recovery Needs a Different Strategy

Business debt is not just “bigger consumer debt.” It behaves differently and needs its own collections strategy.

Commercial debts, commercial rules

These are obligations between companies, guided mainly by:

-

Contracts and terms & conditions

-

Commercial codes and state rules

-

Licensing requirements

-

General “unfair practices” standards

That environment gives more flexibility in how a commercial debt collection agency can approach a business debtor, but it also demands discipline and professionalism.

Relationships and reputation matter

A slow-paying customer might still be one of your most important accounts. One harsh phone call or clumsy letter can damage:

-

Future sales

-

Referrals

-

Online reviews and brand trust

Good B2B collections are firm on the money, respectful in tone and always aware of the bigger relationship.

Complex invoices and disputes

B2B commercial debt recovery often involves:

-

Retainers and milestone billing

-

Change orders and project overruns

-

Disputes around performance or quality

Effective recovery work separates genuine disputes from simple delay tactics and builds solutions both sides can accept.

The CA-USA B2B Collections Process

CA-USA follows a structured, business-friendly process designed to maximize recovery while keeping most matters out of court.

1. Solid Setup: Credit and Contracts

Effective B2B debt recovery starts at the front end:

-

Basic credit checks on new business customers

-

Sensible credit limits based on risk

-

Clear payment terms, due dates and late-fee language

-

Clauses covering collection costs, jurisdiction and dispute handling

Good paperwork now means stronger leverage if invoices become overdue later.

2. Clean Invoicing and Early Follow-Up

Most business customers will pay if you make it easy and stay visible:

-

Accurate, timely invoices with correct PO numbers, line items and tax details

-

Prompt sending instead of waiting weeks after delivery

-

Automated reminders before and after the due date

-

Friendly follow-ups from AR or the account manager in the first 30–45 days past due

This keeps good relationships intact and prevents simple oversights from turning into serious collection problems.

3. Internal Escalation

When balances drift into 60–90 days past due with no valid dispute:

-

Escalated communication from finance leadership

-

Temporary credit hold on new orders or services

-

A clear final internal demand with amount, deadline and consequences

At this stage, every extra week of delay erodes the chance of full recovery. This is usually the right moment to move the file to CA-USA’s business debt recovery services.

4. Professional B2B Collections with CA-USA

Once files are placed, CA-USA moves quickly but professionally:

-

File review and skip-tracing

Contracts, invoices and prior emails are reviewed. Where helpful, business status, ownership and financial clues are refreshed. -

Structured outreach

Focused letters, emails and calls go directly to people who can authorize payment—owners, controllers, CFOs, AP managers. The tone is firm, factual and respectful. -

Negotiation and payment arrangements

CA-USA works toward either a lump-sum payment or a short, realistic payment plan. Settlement options are used carefully so you recover more than you would by simply waiting it out. -

Commercial credit reporting leverage

For seriously delinquent and non-responsive accounts, CA-USA can report to major business credit bureaus such as:-

Dun & Bradstreet (D&B)

-

Experian Business

-

Equifax Business

A negative mark on a company’s business credit file makes future financing and vendor terms tougher—often enough to bring them back to the table without a legal fight.

-

5. Legal Options – Used Carefully and Sparingly

Only a small minority of claims are a good fit for full-blown litigation. Before recommending legal action, CA-USA looks at:

-

Strength of documentation and contracts

-

Evidence that the debtor has assets or ongoing operations

-

Realistic legal cost vs. likely recovery

Even when a lawsuit is filed, most B2B commercial debt cases are resolved without an actual court trial. The credible possibility of legal action often leads to negotiated settlements, consent judgments or payment agreements. Litigation is a lever, not a default.

High Recovery, Protected Reputation

CA-USA is built around three priorities that matter most for B2B commercial debt recovery.

1. Strong recovery rates

By intervening early, using structured workflows and leveraging multiple channels (including business credit reporting), CA-USA routinely sees recovery rates nearing 80% on fresh, well-documented placements.

Older and heavily aged accounts are tougher for everyone, which is why timing matters so much.

2. Brand-safe communication

Every touchpoint is designed to protect your reputation and long-term relationships:

-

No theatrics or personal attacks

-

Clear, calm explanations of what is owed and what happens next

-

Consistent documentation of all contacts

This approach helps you collect past-due invoices without damaging your brand.

3. Resolution without unnecessary court battles

The vast majority of files are resolved through:

-

Negotiation

-

Payment plans

-

Credit-bureau leverage

Most clients see results without ever stepping into a courtroom, which keeps legal costs down and allows your team to stay focused on running the business.

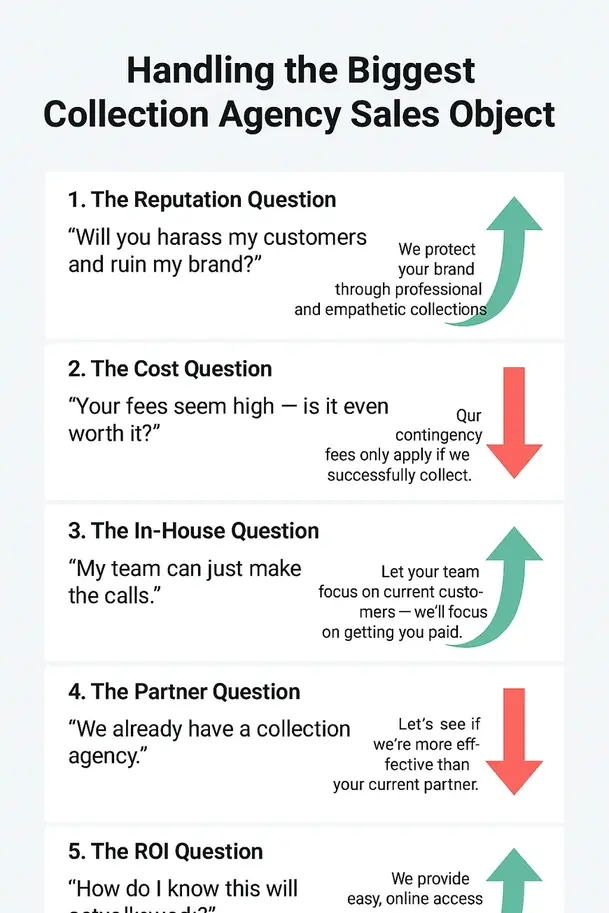

What Makes CA-USA Different from Other Commercial Collection Agencies?

Plenty of firms say they collect B2B debt. A few things set CA-USA apart as a commercial debt collection agency:

-

Proven performance

Recovery rates on fresh placements regularly approach 80%, keeping more of your hard-earned revenue in your bank account instead of the write-off column. -

Reputation you can see

CA-USA holds a Google rating of about 4.85 out of 5, reflecting how both clients and counterparties experience the work—firm, fair and professional. -

Deep commercial focus

The team works exclusively with business-to-business portfolios, across industries and balance sizes, so strategies are built for corporate decision-makers rather than consumers. -

Balanced pressure and tools

Phone, email, letters, the option to report to D&B, Experian Business and Equifax Business, and, when justified, legal escalation are combined in a controlled way. The goal is the same every time: get you paid without blowing up the relationship. -

Transparent, data-driven process

You see where each file stands, what’s been tried, and what’s planned next. That clarity makes it easy to defend your collections strategy internally and fine-tune your credit policies.

FAQs About B2B Commercial Debt Recovery with CA-USA

1. When should I send B2B accounts to a commercial debt collection agency?

A good rule of thumb is to consider placement when an invoice hits 90+ days past due with no valid dispute and no realistic payment plan. At that point, recovery odds start to fall sharply, and professional B2B collections can protect you from unnecessary write-offs.

2. Can CA-USA report my customer’s unpaid debt to business credit bureaus?

Yes. For seriously delinquent and non-responsive accounts, CA-USA can use business credit bureau reporting to Dun & Bradstreet (D&B), Experian Business and Equifax Business as part of the recovery strategy. This adds real-world consequences without jumping straight to litigation.

3. Will B2B commercial debt recovery damage my relationship with the customer?

It doesn’t have to. CA-USA’s process is firm but respectful. The focus is on facts, contracts and clear expectations, not embarrassment or pressure tactics. Many customers continue doing business after resolving their past-due balances.

4. Do most B2B collection cases end up in court?

No. 90% cases are resolved through negotiation, payment plans and credit-bureau leverage. Litigation is used selectively for larger, well-documented debts where there is a realistic chance of recovery.

5. How does CA-USA measure success in B2B commercial debt recovery?

Key metrics include recovery rate, speed of recovery, impact on bad-debt write-offs and client satisfaction. The nearly 80% recovery rate on fresh placements and a 4.85★ Google rating are strong indicators of performance.

When a business customer slides past 60–90 days with no clear plan, that invoice is quietly turning into bad debt. A defined, SEO-friendly and results-driven process—clean invoicing, internal escalation, timely placement with CA-USA, smart use of commercial credit bureaus and legal options only when needed—turns those aging balances back into working cash.

That’s what effective B2B commercial debt recovery looks like when it’s done right.

Start your recovery process? Contact us