Recover Revenue in a “Debtor-Friendly” State

Everything is bigger in Texas—including the challenge of collecting unpaid debts. Texas is known as a “debtor-friendly” state because its laws uniquely protect assets and wages. For a business or medical practice trying to recover what is owed, these hurdles can feel insurmountable.

Collection Agency USA turns those hurdles into stepping stones. We are a specialized Texas collection agency that understands how to navigate the Texas Debt Collection Act (TDCA) and bypass the state’s restrictions to get you paid.

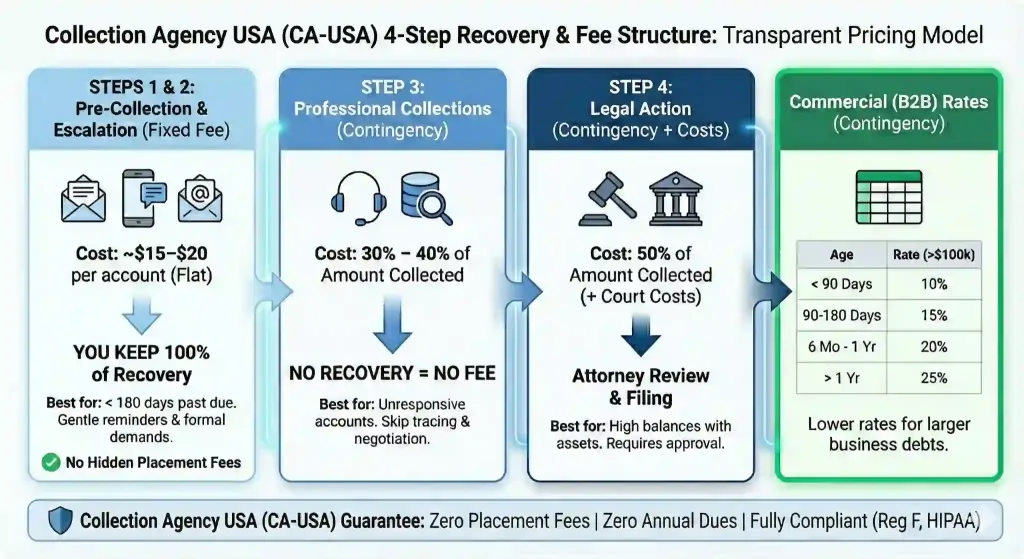

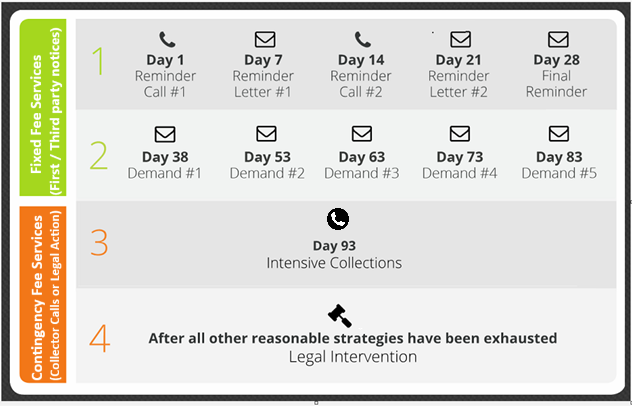

We provide flexible financial solutions, offering both fixed-fee and contingency-based services to align with your budget and risk tolerance. Our operations are backed by rigorous security protocols, and our methodology is specifically designed to resolve matters professionally while safeguarding your hard-earned reputation.

Texas Debt Facts: What Creditors Must Know

-

4 Years: The Statute of Limitations on debt in Texas (Texas Civil Practice & Remedies Code). If you wait longer than 4 years to file suit, the debt is legally uncollectible.

-

No Wage Garnishment: The Texas Constitution bans wage garnishment for most ordinary commercial and consumer debts. This surprises many out-of-state creditors. (We use Bank Levies and Abstracts of Judgment to enforce payment instead).

-

10 Years: A court judgment in Texas is valid for 10 years and can be renewed for another 10, allowing us to play the long game on large balances.

-

Bonded: We hold the required Surety Bond filed with the Texas Secretary of State, ensuring 100% legal operations.

Why “Standard” Collections Fail in Texas

National agencies often fail in Texas because they treat it like any other state. They threaten wage garnishment (which is illegal here) or miss the 4-year deadline.

We are different.

-

We Know the Loophole: Since we cannot garnish wages, we focus on Bank Account Seizures (Writs of Garnishment on bank accounts). This allows us to freeze and seize funds directly from a debtor’s business or personal account—often a much faster way to collect than taking small bites out of a paycheck.

-

Property Liens: We file an Abstract of Judgment immediately after winning a case. This places a “cloud” on the debtor’s real estate title, ensuring you get paid with interest when they try to sell or refinance their property.

Serving the Texas Triangle & Beyond

Texas has four distinct economies. We tailor our recovery strategy to your region and industry:

Houston (Energy & Medical)

-

Oil & Gas: Recovering high-value invoices for oilfield services, equipment rentals, and MSA disputes in the Permian Basin and Gulf Coast.

-

Medical: Handling patient balances for the massive healthcare systems in the Texas Medical Center with HIPAA-compliant care.

Dallas / Fort Worth (Logistics & Finance)

-

Transportation: We specialize in collecting unpaid freight bills and logistics invoices for the DFW distribution hub.

-

Commercial: Recovering B2B debts for manufacturers and wholesalers.

Austin & San Antonio (Tech & Service)

-

Tech/SaaS: Recovering B2B subscription fees and software contract debts in “Silicon Hills.”

-

Service Industry: Handling high-volume consumer accounts for service providers and property managers.

Our Recovery Solutions

1. Commercial (B2B) Collections

Business debt in Texas moves fast. If a company goes silent, they might be preparing to fold or re-incorporate. We act quickly, reviewing personal guarantees and piercing the corporate veil where possible to ensure owners are held responsible for their debts.

2. Medical Debt Recovery

Texas has strict patient privacy laws. We act as an extension of your billing office, using a soft-touch approach to recover copays and deductibles without triggering complaints or bad reviews.

3. Legal Forwarding

When amicable collection fails, we have a network of Texas creditor-rights attorneys ready to file suit. We handle the litigation management, from filing the petition to executing the post-judgment discovery.

Don’t Let the “4-Year Clock” Run Out

In Texas, time is your enemy. Once the 4-year statute of limitations expires, your leverage is gone.

Need a Local Collection Agency? Contact us

Let us navigate the Texas Debt Collection Act and secure the revenue your business has earned.