Urgent care clinics are vital to our healthcare system, offering immediate medical attention without the long waits of emergency rooms. However, the business model of “High Volume, Low Balance” creates a unique financial trap. With the rise of high-deductible health plans, the $50 copay collected at the front desk is often just a fraction of the final bill.

Consider this: If your front desk misses just $50 in copays or deductibles on 3 patients a day, that totals over $54,000 in lost revenue annually—the equivalent of a full-time nurse’s salary.

At Collection Agency USA, we specialize in the specific needs of Urgent Care. We know that unlike a family practitioner, you may never see that patient again (“transient patients”). We have the tools to recover these one-time debts efficiently and ethically.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free skip tracing, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent medical collection results.

Need a Medical Collection Agency? Contact us

The Hidden Financial Strain: “Deductible Shock”

Unpaid medical bills are a growing concern nationwide. For urgent care clinics, the biggest issue is “Deductible Shock.” Patients often believe their copay covered the visit, only to ignore the bill that comes 30 days later for the remaining deductible. By partnering with a specialized agency, you can hand off these difficult conversations to professionals who know how to explain the balance and secure payment without angering the patient.

Unique Challenges Faced by Urgent Care Clinics

1. Transient “Ghost” Patients:

Urgent Care patients often have no loyalty; they visited you simply because you were the nearest open clinic. This makes them hard to chase.

-

The Solution: We utilize Advanced Skip Tracing. Even if the patient has moved or changed numbers since their one-time visit, our data systems can locate them to ensure delivery of the bill.

2. High Volume of Small Balances

You likely have hundreds of accounts owing $50–$150. Your staff cannot spend hours chasing these small amounts.

-

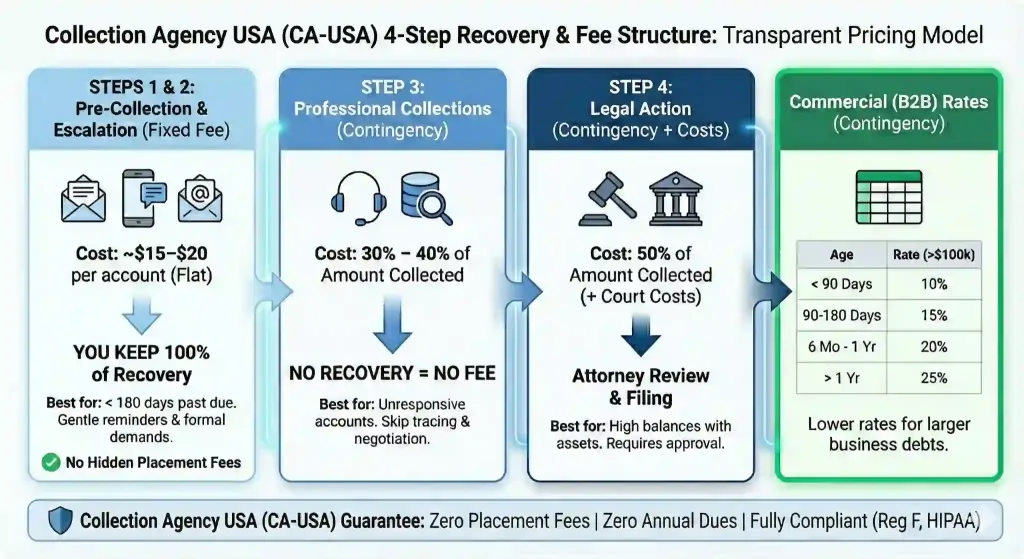

The Solution: Our Fixed-Fee Letter Service is perfect for this. For a low flat rate (approx. $15/account), we automate the cleanup of these small balances. You keep 100% of the revenue.

Think of it this way: For less than the cost of a flu shot (approx. $15), we can recover a $150 balance. You keep 100% of the collected funds, often seeing a 10x Return on Investment on these small accounts.

3. Occupational Medicine (B2B Debt)

Many Urgent Cares provide drug screens and physicals for local employers. When a business fails to pay for these services, it isn’t medical debt—it is Commercial Debt.

-

The Solution: We have a dedicated B2B team to recover unpaid invoices from corporate accounts, ensuring your Occupational Health revenue stream remains healthy.

Strategies for Financial Recovery

Implement Clear Payment Policies

Communicate expectations upfront. However, when policies fail, you need a backup plan.

Leverage Technology (24/7 Payments)

Urgent Care patients are used to speed. They open their mail at 7 PM on a Tuesday. We provide 24/7 Mobile-Optimized Payment Portals so patients can pay their balance instantly via their smartphone, preventing “bill fatigue.”

Patient Portal Integration

We can integrate with your billing software. Unpaid invoices can trigger automatic, tiered outreach (email, SMS, soft calls) after a set number of days. Clinics get the benefit of proactive collections without manually chasing each account.

| Need a Collection Agency to Recover your Urgent Care Patient Bills? Contact Us At CA-USA, we specialize in helping urgent care clinics recover outstanding debts efficiently and ethically. Our customized solutions maximize recovery rates while preserving patient relationships. |

Why Partner with a Professional Collection Agency?

A professional collection agency offers:

-

Expertise in Medical Debt Recovery: Employing proven strategies tailored to healthcare.

-

Regulatory Compliance: Ensuring adherence to HIPAA, the No Surprises Act, and the Fair Debt Collection Practices Act (FDCPA).

-

Preservation of Patient Relationships: We handle the “Deductible Conversation” professionally, preserving your clinic’s reputation in the community.

- Billing Code Knowledge: We understand the difference between a 99214 (Level 4 Visit) and a simple wellness check. Our collectors can explain the ‘Why’ behind the bill to patients, reducing disputes by over 30%.

Success Stories

Clinics partnering with a collection agency have reported:

-

35% Reduction in Bad Debts: Significant decreases in unpaid bills within months.

-

Occupational Health Recovery: Recovering thousands in unpaid invoices from local businesses for employee screenings.

Contact Us Today If your urgent care clinic is facing challenges with unpaid bills—whether from patients or local employers—contact us today to discover how our collection agency can improve your financial stability.