When medical bills go unpaid, healthcare providers often rely on collection agencies to recover outstanding balances. Choosing the right agency is critical for maintaining financial health and preserving patient relationships. This article offers comprehensive insights into shortlisting a medical collection agency in California, with a focus on key considerations, legal compliance, and practical scenarios.

Need a Collection Agency? Contact us

Factors to Consider When Shortlisting a Medical Collection Agency

1. Experience and Expertise

- Industry-Specific Knowledge: Choose agencies specializing in medical debt collection. These agencies understand healthcare regulations, billing intricacies, and patient sensitivities, ensuring compliance and ethical practices.

- Types of Medical Debt: Ask about the agency’s experience with various forms of medical debt, including primary care, hospital bills, and specialized treatments.

- Proven Track Record: Opt for agencies with years of experience and measurable success in recovering medical debt. Agencies with a long-standing presence in the healthcare sector often demonstrate a deeper understanding of the unique challenges involved.

2. Success Rate and Collection Strategies

- Recovery Rate: Prioritize agencies with a high success rate. While industry averages can serve as a benchmark, it’s crucial to seek agencies that consistently outperform them.

- Ethical Practices: Ensure the agency adheres to ethical standards, avoiding aggressive or deceptive tactics. Look for agencies that respect patient dignity while pursuing collections.

- Technological Advancements: Agencies using data analytics to segment patient accounts and personalize strategies often achieve superior results. For instance, using analytics to determine the likelihood of payment can refine the approach.

- Multilingual Patient Communication – In California’s diverse population, offering debt recovery in Spanish, Mandarin, or other common languages builds trust and improves recovery rates.

- Coordination with Insurance Appeals – Many unpaid balances stem from denied claims. A collection partner that helps track appeals and coordinates with insurers reduces disputes and speeds up payment.

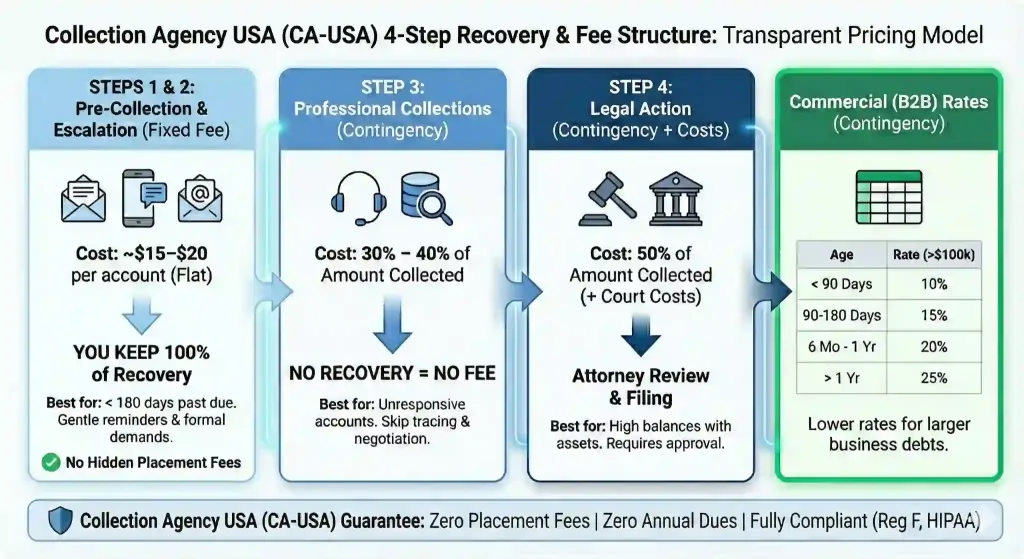

3. Pricing Structure and Transparency

|

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free skip tracing, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & HIPAA compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience, delivering excellent medical collection results. Need a Medical Collection Agency? Contact us Transparent Recovery PricingWe believe in straightforward math, tailored to your risk comfort:

|

- Fixed-Fee Services: This structure involves a flat fee for specific collection tasks. Fixed-fee services are ideal for newer accounts where recovery likelihood is high, making it a cost-effective solution.

- Contingency Fee Services: Under this model, the agency takes a percentage of the amount recovered. This approach is commonly used for older or more challenging accounts where upfront costs may not be justified.

- Transparency: Regardless of the pricing model, ensure complete transparency in costs to avoid hidden fees.

4. Compliance and Regulatory Adherence

- California-Specific Laws: California’s Rosenthal Fair Debt Collection Practices Act prohibits abusive or deceptive collection practices. Medical collection agencies must also comply with time-barred debt regulations and provide clear, written communication during their initial contact with debtors.

- HIPAA Compliance: Patient data privacy is paramount. Ensure the agency prioritizes data security and complies with HIPAA regulations.

5. Reputation and Reviews

- Client Testimonials: Seek feedback from other healthcare providers. Positive testimonials can indicate strong performance and ethical standards.

- Online Reputation: Research reviews and ratings on trusted platforms. A solid online presence often reflects professionalism and reliability.

California-Specific Medical Debt Collection Laws

- Rosenthal Fair Debt Collection Practices Act: This law ensures that debt collectors operate transparently and without harassment or deceit.

- Time-Barred Debt: Agencies are restricted from filing lawsuits for debts past the statute of limitations and must include specific language in their initial communication regarding time-barred debts.

- AB 1020: This law limits the ability of healthcare providers to transfer unpaid bills to collections without offering a fair payment plan or making a good-faith effort to contact the patient.

- Hospital Fair Pricing Act: Requires hospitals to offer reduced payment plans to low-income patients before transferring debts to collections.

Real-World Scenarios in Debt Recovery

- Scenario 1: Miscommunication Leading to Delays A patient disputes a bill due to lack of clarity on insurance coverage. An experienced medical collection agency mediates between the healthcare provider and patient, ensuring accurate billing and prompt payment resolution.

- Scenario 2: Legal Compliance An agency’s failure to provide clear disclosures leads to a lawsuit under California’s debt collection laws. Healthcare providers must ensure the agency’s strict adherence to legal requirements to avoid liability.

- Scenario 3: Ethical Recovery Practices A patient undergoing financial hardship faces aggressive collection tactics. Choosing an agency with an empathetic approach protects the provider’s reputation while achieving recovery goals.

Conclusion

Selecting a medical collection agency in California requires careful consideration of expertise, ethical practices, compliance with state laws, and transparency in pricing. Fixed-fee services are cost-effective for newer accounts, while contingency fees suit older debts. Agencies that adhere to California’s strict medical debt collection laws and prioritize patient relationships stand out as reliable partners for healthcare providers. By conducting thorough evaluations and choosing wisely, healthcare providers can achieve effective debt recovery without compromising their values.