Farm supply and agriculture businesses expect a collection agency to be easy to use and to offer cost-effective services. In this industry, the agency must efficiently recover overdue accounts receivable while preserving your most valuable asset: your relationship with the grower.

At Collection Agency USA, we understand that agriculture operates on a different clock than the rest of the business world. We know that cash flow is seasonal, and your customers are often waiting on harvest yields or government subsidies.

We don’t just collect debt; we understand Agribusiness. Whether you are selling seed, feed, fertilizer, fuel, or heavy equipment, we have the tools to recover your capital without becoming the enemy of the local farming community.

We Understand: Relationships Are Everything

Because the pool of customers in a farming community is not vast, it is crucial for businesses operating in the agriculture sector to focus on retaining the customers they already have. A heavy-handed approach can ruin a relationship that has lasted generations. That is why we use a “Diplomatic Recovery” method first.

Hire a Collection Agency: Contact usServing nationwide |

Our “Harvest-Cycle” Recovery Process (Steps 1–4)

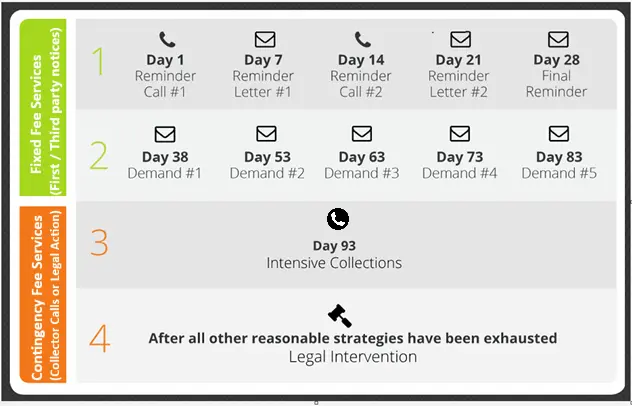

A collection agency should offer flexible options that match the age of the debt. We offer a structured approach designed to escalate only when necessary.

Step 1: The “Soft” Reminder (Fixed Fee)

-

Best for: Accounts 60–90 days past due (or post-harvest delays).

-

The Service: We send a series of professional, diplomatically worded letters reminding the grower of their obligation.

-

The Benefit: You pay a low flat fee (approx. $15/account). You keep 100% of the money collected. This looks like a standard administrative follow-up, preserving your relationship.

Step 2: Escalated Demands (Fixed Fee)

-

Best for: Accounts that ignored Step 1.

-

The Service: The tone becomes firmer. We send attorney-approved demand letters that signal serious intent.

-

The Benefit: Still a low fixed cost. It shows the debtor that you have escalated the matter to a third party.

Step 3: Intensive Collections (Contingency)

-

Best for: Accounts 120+ days old or broken promises.

-

The Service: Our specialized agricultural collectors begin phone negotiations. We work to understand the debtor’s true financial position—are they waiting on a crop check? Is there a dispute? We negotiate payment plans aligned with their revenue events.

-

The Cost: No recovery, no fee. We only get paid a percentage of what we collect.

Step 4: Legal Litigation

-

Best for: Large commercial balances or refusal to pay despite assets.

-

The Service: If all else fails, and with your explicit permission, we can forward the file to our network of attorneys to pursue legal judgments or enforce agricultural liens.

Best Practices: Before You Send to Collections

1. Send Prompt and Clear Invoices

Farmers are busy. Issue invoices immediately after delivering crops, livestock, or supplies. Ensure terms (Net 30, Net 60) are clearly stated.

2. Follow Up Consistently

A polite reminder shortly after the due date ensures accounts don’t go stale. If you don’t have the staff for this, our Step 1 service is the perfect outsourcing solution.

3. Recognize the “Red Flags”

If a grower is avoiding your calls after harvest, or if they are buying supplies from a competitor while owing you money, it is time to act.

Common Reasons for Overdue Ag Accounts

Farm supply businesses often extend credit to accommodate the seasonal nature of agriculture, where expenses for seeds and chemicals occur months before income is realized. However, you are not a bank. Overdue accounts often stem from:

-

Cash Flow Gaps: Waiting for commodity sales.

-

Yield Issues: Poor crops or weather events.

-

Disputes: Claims of equipment malfunction or product efficacy.

Don’t let your invoices wait for “next season.“ Recover your funds while maintaining professional respect.