Most people associate hospitals and clinics with healing, not invoices. Yet unpaid medical bills are a fast‑growing line item on the balance sheet of nearly every provider. Collecting those balances brings its own set of hurdles—many of which simply don’t exist in typical consumer or B2B collections.

1. Strict Privacy & Compliance Rules

- HIPAA restrictions prevent agencies from seeing—or even discussing—certain patient details unless airtight Business Associate Agreements are in place.

- State surprise‑billing laws and No Surprises Act protections create extra disclosure requirements at every step of the revenue cycle.

Example: A regional imaging center had to redact diagnostic codes from every past‑due statement before forwarding accounts, adding weeks to its internal workflow.

2. Emotion‑Driven Payment Decisions

Healthcare debt often follows illness, trauma, or job loss, so patients can be anxious—or angry—when collectors call. A hard‑sell script that works fine for retail cards can tank response rates here.

- Patient trust and brand reputation matter; an overly aggressive call could trigger a social‑media backlash that costs far more than the balance owed.

- Medical credit scores (e.g., VantageScore 4.0) weigh medical debt differently, meaning consumers may not feel the same urgency to pay.

Example: A children’s hospital replaced its robo‑dialer with SMS reminders that include a “Need help? Click to set a payment plan” button. Roll‑to‑agent escalations dropped 38 %, and monthly recoveries climbed.

3. Insurance and Coding Complexities

Disputes rarely hinge on willingness; they hinge on EOB confusion, denials, and miscoded CPTs.

- Coordination‑of‑benefits delays keep charges in limbo.

- Patients often assume insurers will eventually pay—and ignore collection letters in the meantime.

4. High‑Dollar, Low‑Frequency Balances

A hospital may carry fewer accounts than a utility company, but each bill is larger. That makes recovery cycles lumpy and forecasting tricky.

5. Fragmented Account Ownership

One emergency room visit can generate four separate bills (facility, physician group, lab, radiology). Patients see “one hospital” and get frustrated by multiple collectors.

Five Field‑Tested Strategies to Overcome These Obstacles

| Strategy | Why It Works |

|---|---|

| Compassion‑First Scripting | Acknowledges hardship, keeps net‑promoter scores intact, and satisfies CFPB expectations of “consumer‑focused” communication. |

| Omnichannel Self‑Service | Mobile‑friendly portals let patients verify insurance, upload documents, and choose a payment plan without human friction. |

| Insurance Follow‑Up Teams | Specialized reps chase down payors, correct coding errors, and resubmit claims—often converting a “bad debt” into reimbursed revenue. |

| Consolidated Billing | Rolling multiple provider invoices into one statement reduces patient confusion and call volume, boosting first‑touch resolutions. |

| Data‑Driven Segmentation | Machine‑learning models flag charity‑care candidates vs. high‑propensity payers, ensuring the right account hits the right workflow. |

Quick Wins You Can Implement This Quarter

- Add QR codes to paper statements that launch a mobile wallet checkout.

- Sync with patient‑engagement apps (MyChart®, Healow®, etc.) so balances appear alongside test results.

- Create a micro‑video for first‑notice emails explaining insurance vs. patient responsibility.

Why us

- Patient Education on Billing

We provide clear explanations of charges and insurance adjustments, reducing confusion that often delays payment. - Flexible Installment Plans

Offering structured payment plans aligned with patient budgets helps increase recovery while maintaining goodwill. - Early-Out Programs

Our team can step in right after billing to handle reminder calls and letters—preventing accounts from ever becoming delinquent. - Compliance with State-Specific Rules

Beyond HIPAA, we stay current on evolving state healthcare debt laws, ensuring providers remain fully compliant.

CA-USA provides a low cost, compliant, reputation-safe approach, equipped with all 50-state collections license, offering free skip tracing, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II and HIPAA compliant. Over 2,000 online reviews rate us 4.85 out of 5. Over 20 years experience , delivering excellent medical collection results.

Need a Medical Collection Agency? Contact us

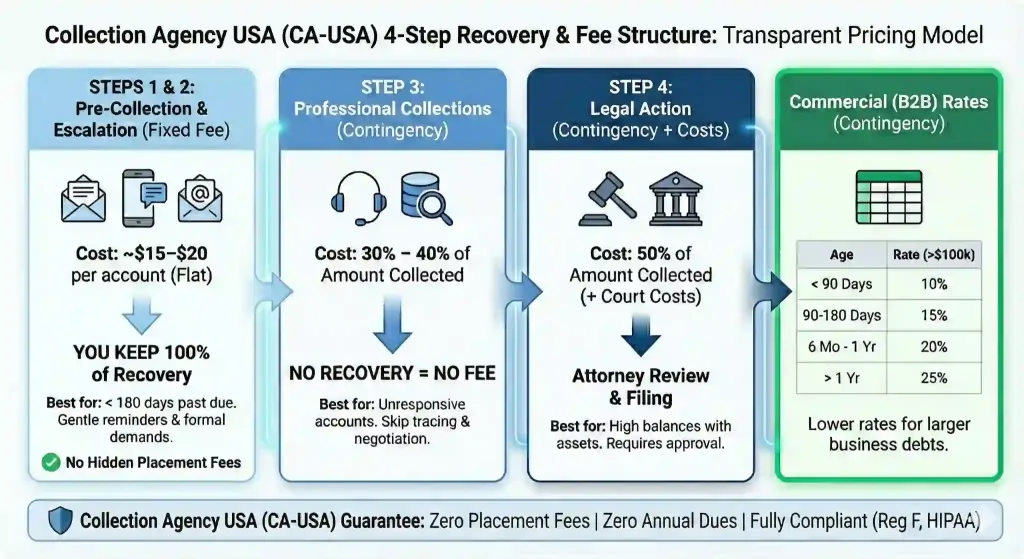

Our Simple Pricing:

$15 for fixed fee collections, 40% for Contingency Colelctions

Final Thoughts

Healthcare collections demand empathy, airtight compliance, and surgical‑level precision in handling insurance data. Providers who blend patient‑friendly communication with tech‑powered workflows recover more revenue—and preserve the goodwill that keeps communities trusting their care.